Should You Buy the Post-Earnings Pop in Pure Storage Stock?

/The%20Pure%20Storage%20logo%20on%20an%20office%20building%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

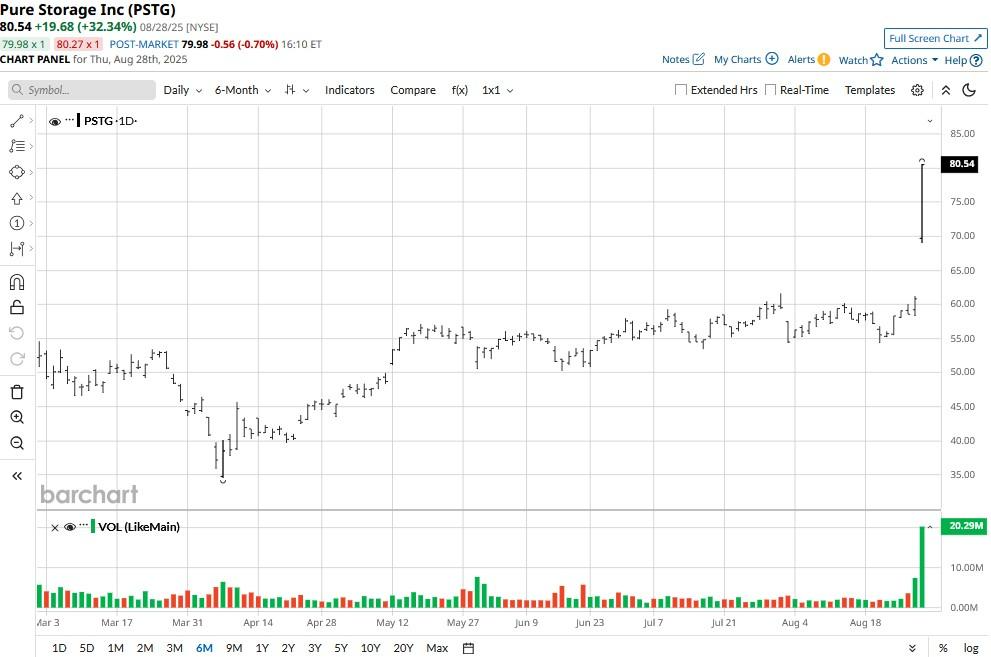

Pure Storage (PSTG) shares closed more than 30% higher on Thursday after the enterprise-grade data storage solutions company reported an impressive Q2 and raised its guidance for the full year.

The company’s management now expects revenue to fall between $3.6 billion and $3.63 billion in fiscal 2025 – well ahead of $3.52 billion it had forecast earlier.

Including the post-earnings surge, Pure Storage stock is trading at more than double its price in the first week of April.

Is Valuation Really a Concern for Pure Storage Stock?

PSTG stock is now going for an overly stretched forward price-earnings (P/E) multiple of 107x.

However, valuation may still not be a major concern for Pure Storage given “this market is addicted to easy money,” said Dan Niles, a renowned portfolio manager in a CNBC interview today.

In the current environment, he added, “you’re paid to take risks.”

On Thursday, Fundstrat’s top strategist Tom Lee also revealed the momentum trade isn’t showing any signs of fading, at least anytime soon.

His remarks further substantiate that investors shouldn’t be overly concerned about Pure Storage’s valuation, especially after the company recorded a blockbuster quarter and raised its guidance for the future.

What Could Drive PSTG Shares Higher in 2025

Pure Storage shares remain attractive also because they offer a means of “playing into the artificial intelligence environment in multiple ways,” according to the company’s chief executive Charles Giancarlo.

In a post-earnings interview, Giancarlo said an AI environment is all about “performance,” touting his company’s “FlashBlade Exa,” whose industry-leading benchmarks continue to attract massive demand.

PSTG is the primary storage supplier for Meta Platforms (META). On Thursday, the NYSE-listed firm said it’s on track to deploy as much as 2 exabyte of capacity with the tech titan by year-end.

That made UBS analysts increase their price objective on PSTG shares today to $85, indicating potential for another 6% upside from here.

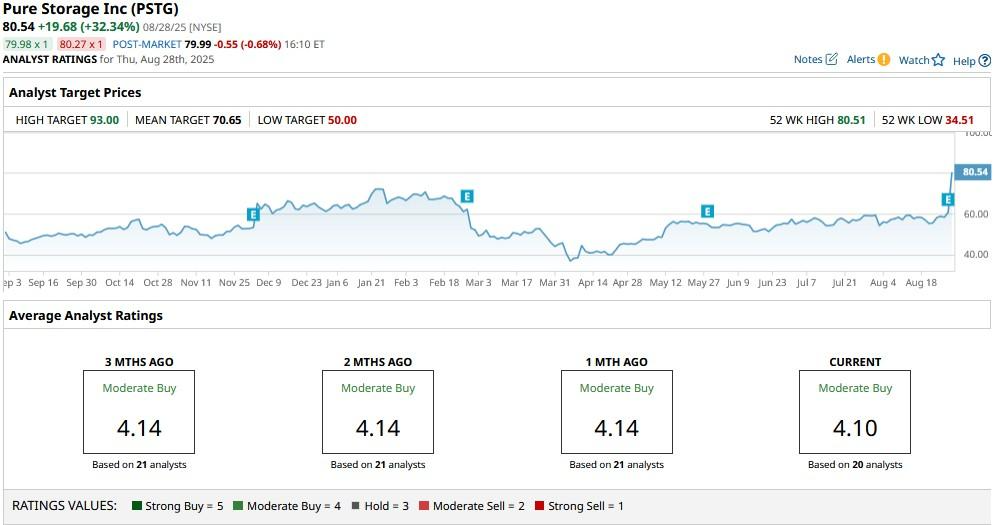

Pure Storage Is a ‘Buy’-Rated Stock Among Wall Street Analysts

Wall Street currently has a consensus “Moderate Buy” rating on Pure Storage shares.

And while the mean target of roughly $71 indicates meaningful downside from here, investors should note that some analysts may soon revise their estimates upwardly for PSTG stock due to the company’s encouraging earnings release.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.