Is Oklo Stock a Buy, Sell, or Hold for September 2025?

Oklo (OKLO), a next-generation nuclear energy provider that joined public markets just last year via a special purpose acquisition company (SPAC) merger, has quickly found itself in the spotlight amid growing momentum for nuclear power.

This resurgence of interest in nuclear comes as the rapid growth of artificial intelligence (AI) and the expansion of energy-hungry data centers put increasing pressure on the electricity supply, prompting fresh discussions about reliable, low-carbon energy sources.

While Oklo remains in its pre-revenue phase, its stock has been anything but quiet, delivering a massive triple-digit return over the past year and experiencing notable volatility as investors continue to speculate on the role of nuclear energy in meeting future energy demands.

About Oklo Stock

Oklo’s success story hinges on its next-generation nuclear technology built around microreactors, which are compact, efficient units designed to operate for years without refueling. Utilizing advanced metallic uranium fuel, these systems are designed to deliver steady, low-carbon power, meeting the increasing demands of AI, data centers, and other energy-intensive sectors.

One of Oklo’s standout features is its work on recycling spent nuclear fuel, a method that could make nuclear power more sustainable while reducing the amount of long-term nuclear waste. The company has seen strong government backing as it moves its projects forward.

It was the first company to secure a site use permit from the U.S. Department of Energy for a commercial advanced fission plant, receive a fuel award from Idaho National Laboratory, and submit the first custom combined license application for an advanced reactor to the U.S. Nuclear Regulatory Commission. In addition, Oklo is partnering with the Department of Energy and national laboratories on advanced fuel recycling technologies, highlighting federal interest in its vision for next-generation nuclear power.

Currently valued at about $11.5 billion by market capitalization, shares of this California-based company have skyrocketed an astounding 1,055% over the past year, dwarfing the broader S&P 500 Index’s ($SPX) 15.5% return during the same stretch. Year-to-date (YTD), the stock is up an eye-popping 248%, compared to just 9.8% for the broader index.

A Look Inside Oklo’s Q2 Earnings Report

Oklo reported its fiscal 2025 second-quarter earnings on Aug. 11, revealing a mixed financial picture. While revenue remains absent, the company reported a net loss of $0.18 per share, narrower than last year’s $0.27 loss per share but still wider than the consensus estimate of $0.12, as operating expenses increased to $28 million in Q2 from $17.8 million recorded in the same period last year.

Even with the higher spend, Oklo ended the quarter with a strong $683 million in cash and marketable securities, boosted by $440.1 million in gross proceeds from a follow-on equity raise. On a YTD basis, cash burn stood at $30.7 million, well within its annual guidance range of $65 million to $80 million, signaling tight control over its spending.

Oklo used its latest earnings update to spotlight major operational milestones. The company reiterated its goal to launch its first commercial Aurora reactor between late 2027 and early 2028, with pre-construction activities expected to begin in Q3 of fiscal 2025. Regulatory work is also progressing, including the submission for Phase 1 of Aurora’s combined license application (COLA) in early Q4.

Oklo also launched a public licensing dashboard to track its progress. Partnership momentum was another focal point for the nuclear energy provider. The company strengthened its ties with Liberty Energy (LBRT) to deliver integrated hybrid power solutions and joined forces with Vertiv (VRT) to co-develop advanced energy and cooling systems for data centers in response to surging data center power demand in the U.S.

Meanwhile, a new collaboration with Korea Hydro & Nuclear Power aims to open doors to international markets. Oklo also entered a strategic collaboration with Lightbridge (LTBR), an advanced nuclear technology company. The goal is to accelerate the commercialization of advanced nuclear fuel through joint fabrication, research and development, as well as the utilization of repurposed plutonium from legacy materials.

What Do Analysts Think About Oklo Stock?

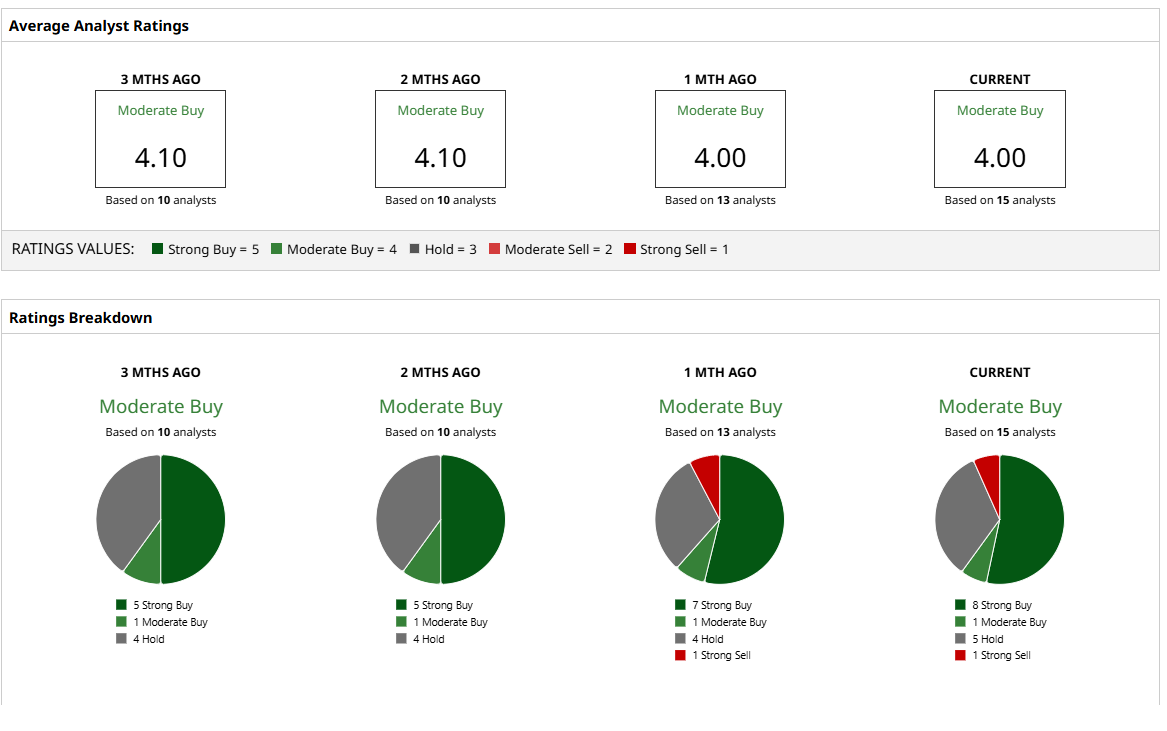

Oklo has earned Wall Street’s confidence, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 15 analysts covering the stock, eight have rated it a “Strong Buy,” one suggests a “Moderate Buy,” five analysts are playing it safe with a “Hold,” and the remaining one gives a “Strong Sell” rating.

OKLO is already trading at a premium to its consensus price target of $71.33. However, the Street-high price target of $92 indicates that the stock can still climb as much as 26% from the current market price.

Final Thoughts

While the company remains pre-revenue and continues to post losses, its steady progress on its Aurora reactor, strong cash position, defense contract wins and growing list of strategic partnerships underscore its long-term potential.

For investors, the stock’s monster rally so far means expectations are already sky-high. Still, with regulatory milestones ahead and nuclear power gaining renewed relevance in the global energy mix, Oklo could remain a high-risk, high-reward story worth monitoring closely.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.