Is McDonald's Stock Underperforming the Nasdaq?

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)

Valued at $223.7 billion by market cap, Chicago, Illinois-based McDonald's Corporation (MCD) owns, operates, and franchises over 38,000 restaurants in more than 100 countries across the globe. McDonald’s offerings include burgers, sandwiches, fries, shakes, desserts, soft serve cones, cookies, and more.

Companies worth $200 billion or more are generally described as "mega-cap stocks." McDonald’s fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the restaurant industry. McDonald’s operates as the largest QSR chain in the world.

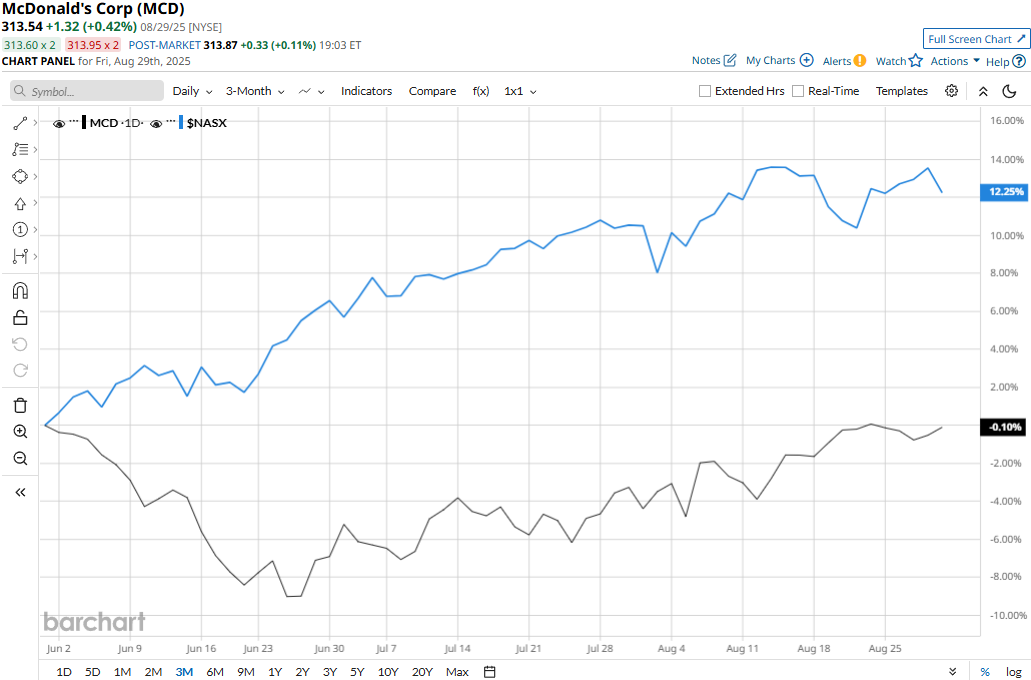

McDonald’s touched its all-time high of $326.32 on Mar. 10 and is currently trading 3.9% below that peak. Meanwhile, MCD stock has observed a marginal 54 bps uptick over the past three months, notably underperforming the Nasdaq Composite’s ($NASX) 11.9% surge during the same time frame.

McDonald's has underperformed the Nasdaq over the longer term as well. MCD stock has gained 8.2% on a YTD basis and 9.2% over the past 52 weeks, compared to NASX’s 11.1% gains in 2025 and 22.2% surge over the past year.

To confirm the recent upturn, MCD stock has remained on an uptrend since late June and traded above its 50-day and 200-day moving averages since last month.

McDonald's stock prices gained nearly 3% in the trading session following the release of its better-than-expected Q2 results on Aug. 6. During the quarter, its global systemwide sales increased by 6% year-over-year. Overall, the company’s topline for the quarter grew 5.4% year-over-year to $6.8 billion, exceeding the consensus estimates by 1.9%. Furthermore, its non-GAAP EPS for the quarter inched up 7.4% year-over-year to $3.19, surpassing the consensus estimates by 1.3%.

On an even more positive note, McDonald's has also outperformed its peer Chipotle Mexican Grill, Inc.’s (CMG) 24.4% plunge over the past 52 weeks and 30.1% decline in 2025.

Among the 34 analysts covering the MCD stock, the consensus rating is a “Moderate Buy.” Its mean price target of $337.96 represents a 7.8% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.