How Is Accenture’s Stock Performance Compared to Other Technology Stocks?

/Accenture%20plc%20logo%20on%20devices-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

Valued at $162.8 billion by market cap, Dublin, Ireland-based Accenture plc (ACN) is a global leader in professional services. Accenture partners with top businesses, governments, and organizations worldwide to enhance their digital foundations, optimize operations, accelerate revenue growth, and improve public services.

Companies worth $10 billion or more are generally described as "large-cap stocks." ACN fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the tech sector.

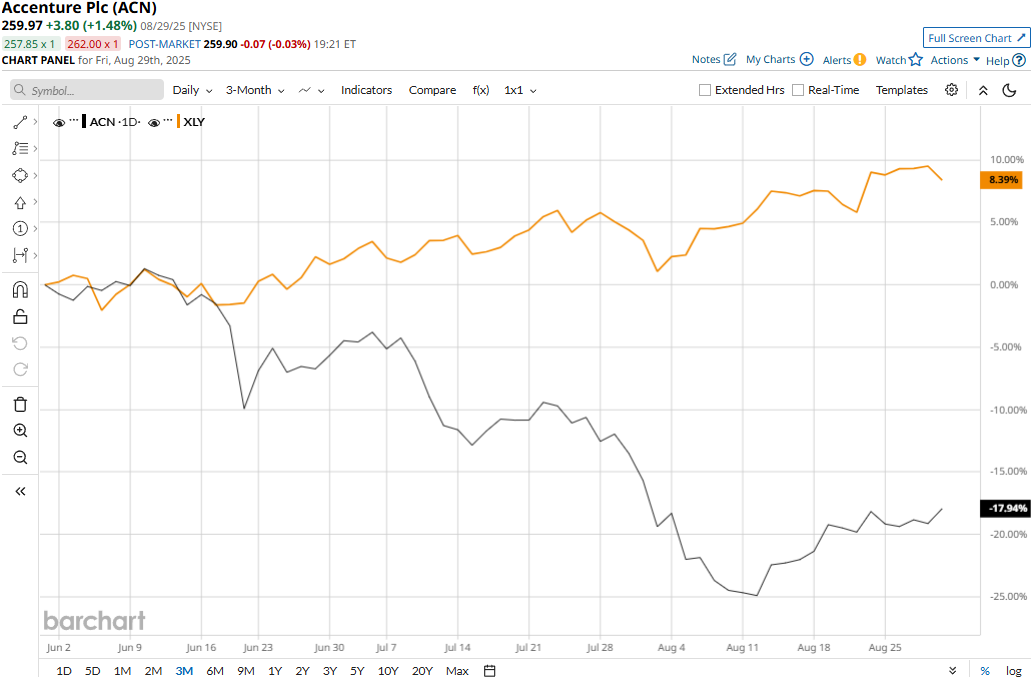

Despite its strengths, Accenture has plummeted 34.7% from its three-year high of $398.35 touched on Feb. 5. Moreover, ACN stock prices have plunged 18.2% over the past three months, significantly underperforming the Technology Select Sector SPDR Fund’s (XLK) 13.3% surge during the same time frame.

Accenture's performance has remained grim over the longer term as well. ACN stock prices have declined 26.1% on a YTD basis and 23% over the past year, underperforming XLK’s 12.9% gains in 2025 and 19.6% returns over the past 52 weeks.

To confirm the downturn, ACN stock has traded consistently below its 200-day moving average since early March and mostly below its 50-day moving average since late February, with some fluctuations.

Accenture stock has remained under pressure in recent months. Its stock prices dropped 6.9% in a single trading session following the release of its Q3 results on Jun. 20. The company’s topline for the quarter increased by a notable 7.7% year-over-year to $17.7 billion, beating Street estimates by 2.6%. Further, growth in earnings and a drop in outstanding shares due to share buybacks led to an impressive 14.8% growth in EPS to $3.49, surpassing the consensus estimates by 5.8%. Moreover, the company also raised its full-year revenue growth guidance from the prior range of 5% to 6% to 6% to 7% (in local currency).

However, Accenture’s new bookings at the end of Q3 stood at $19.7 billion, down 6% year-over-year in USD terms and down 7% in local currency. This dented investor confidence and led to a selloff.

Further, ACN has significantly underperformed its peer, International Business Machines Corporation’s (IBM) 10.8% gains in 2025 and 22.7% surge over the past year.

Nevertheless, analysts remain optimistic about the stock’s prospects. Among the 24 analysts covering the ACN stock, the consensus rating is a “Moderate Buy.” As of writing, Accenture’s mean price target of $336.26 suggests a 29.3% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.