Is Thermo Fisher Scientific Stock Underperforming the Dow?

/Thermo%20Fisher%20Scientific%20Inc_%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $186.6 billion, Thermo Fisher Scientific Inc. (TMO) is a leading global life sciences company that provides analytical instruments, laboratory equipment, reagents, consumables, software, and services for research, diagnostics, and pharmaceutical manufacturing. Headquartered in Waltham, Massachusetts, it operates through Life Sciences Solutions, Analytical Instruments, Specialty Diagnostics, and Laboratory Products & Biopharma Services segments.

Companies valued at $10 billion or more are generally described as “large-cap” stocks, and Thermo Fisher Scientific fits this description perfectly. It holds a leading position in bioproduction and research services, with operational excellence and agility that strengthen investor confidence and market resilience.

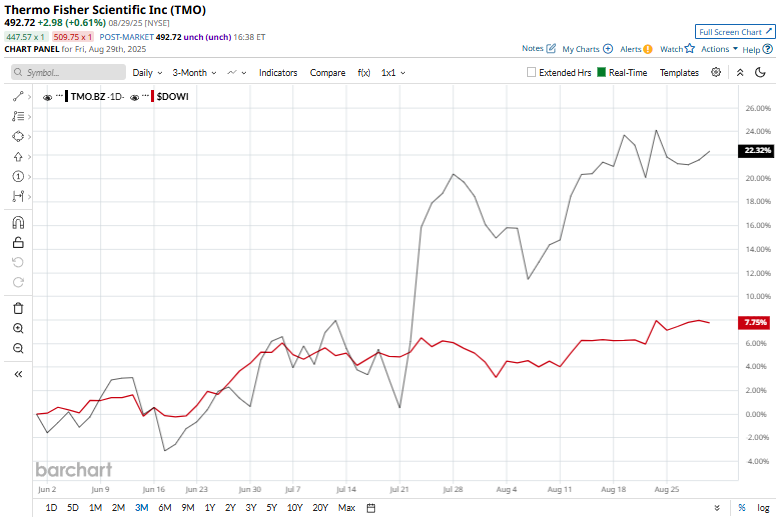

It's not all sunshine and rainbows for the TMO as its shares have retreated 21.5% from its 52-week high of $627.88 touched on Sept. 10 last year. However, TMO stock has surged 22% over the past three months, outpacing the broader Dow Jones Industrial Average’s ($DOWI) 7.9% fall during the same time frame.

However, TMO is down 5.3% on a YTD basis, notably lagging behind $DOWI’s 7.1% rise. Additionally, shares of Thermo Fisher Scientific have dropped 19.6% over the past 52 weeks, trailing the Dow Jones Industrial Average’s 10.8% increase over the same period.

TMO stock has been trading above its 50-day and 200-day moving averages since early July and mid-August, indicating a recent uptrend.

On July 23, Thermo Fisher released its Q2 2025 earnings, and its shares climbed 9.1%. It reported revenue of $10.85 billion, a 3% year-over-year increase, and adjusted EPS stood at $5.36, while adjusted operating income rose to $2.38 billion. Thermo Fisher also highlighted the launch of next-generation instruments, including Orbitrap Astral Zoom, Orbitrap Excedion Pro, and the Krios 5 Cryo-TEM, as well as an expanded DynaDrive single-use bioreactor portfolio.

Top competitor, IDEXX Laboratories, Inc. (IDXX), has outpaced TMO. IDXX has risen 56.5% on a YTD basis and has climbed 34.4% over the past 52 weeks.

Despite TMO’s underperformance over the past year, analysts remain highly optimistic about its prospects. Among the 27 analysts covering the stock, there is a consensus rating of “Strong Buy,” and its mean price target of $550.40 suggests a 11.7% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.