Is T-Mobile US Stock Outperforming the S&P 500?

With a market cap of $283.6 billion, T-Mobile US, Inc. (TMUS) is a leading national wireless service provider offering voice, messaging, data, and high-speed internet services across the United States, Puerto Rico, and the U.S. Virgin Islands. Headquartered in Bellevue, Washington, T-Mobile is a subsidiary of Deutsche Telekom AG and a pioneer in 5G network deployment.

Companies worth more than $200 billion are generally labeled as “mega-cap” stocks, and T-Mobile US fits this criterion perfectly. Operating under the T-Mobile, Metro by T-Mobile, and Mint Mobile brands, the company provides wireless devices, accessories, and financing solutions through retail stores, apps, and third-party distributors.

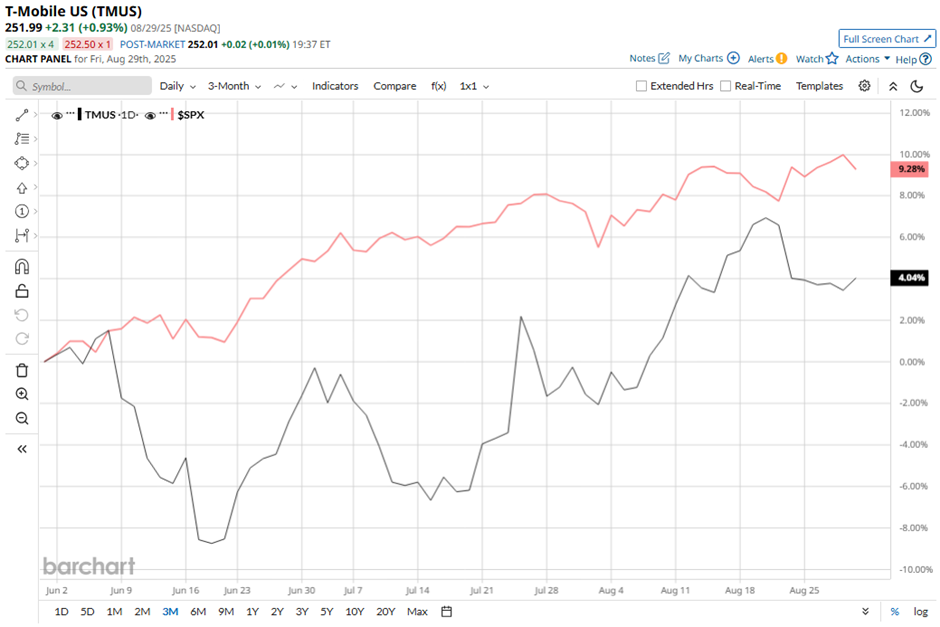

Shares of T-Mobile US have dipped 8.9% from its 52-week high of $276.49. The stock has risen 5.3% over the past three months, lagging behind the broader S&P 500 Index’s ($SPX) 9.3% gain over the same time frame.

In the longer term, TMUS stock is up 14.2% on a YTD basis, outperforming SPX’s 9.8% return. Moreover, shares of the wireless carrier have surged 25.1% over the past 52 weeks, compared to SPX’s 15.5% increase over the same time frame.

Despite a few fluctuations, the stock has been trading mostly above its 50-day and 200-day moving averages since last year.

Shares of T-Mobile climbed 5.8% following its Q2 2025 results on Jul. 23. The company reported EPS of $2.84 and revenue of $21.1 billion, both above expectations. The company raised its full-year postpaid net customer addition forecast to 6.1 million - 6.4 million, after adding 830,000 postpaid phone customers in the quarter. Strong uptake of its new Experience plans, bundled with Netflix and Apple TV+ and chosen by about 60% of new accounts, further boosted investor confidence.

Nevertheless, TMUS stock has lagged behind its rival, AT&T Inc. (T). AT&T stock has soared 47.8% over the past 52 weeks and 28.6% on a YTD basis.

Despite outperforming the SPX over the past year, T-Mobile carries a “Moderate Buy” consensus rating from the 29 analysts covering the stock. The mean price target of $271.55 is a premium of 7.8% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.