Linde Stock: Is LIN Outperforming the Basic Materials Sector?

With a market cap of $224.3 billion, Linde plc (LIN) is a global leader in industrial gases and engineering. The company supplies atmospheric and process gases such as oxygen, nitrogen, hydrogen, and helium, while also designing and building large-scale processing plants.

Companies valued at $200 billion or more are generally considered “mega-cap” stocks, and Linde fits this criterion perfectly. Serving sectors like healthcare, chemicals, energy, manufacturing, food and beverage, and electronics, Linde operates across the United States, Europe, Asia, and other international markets.

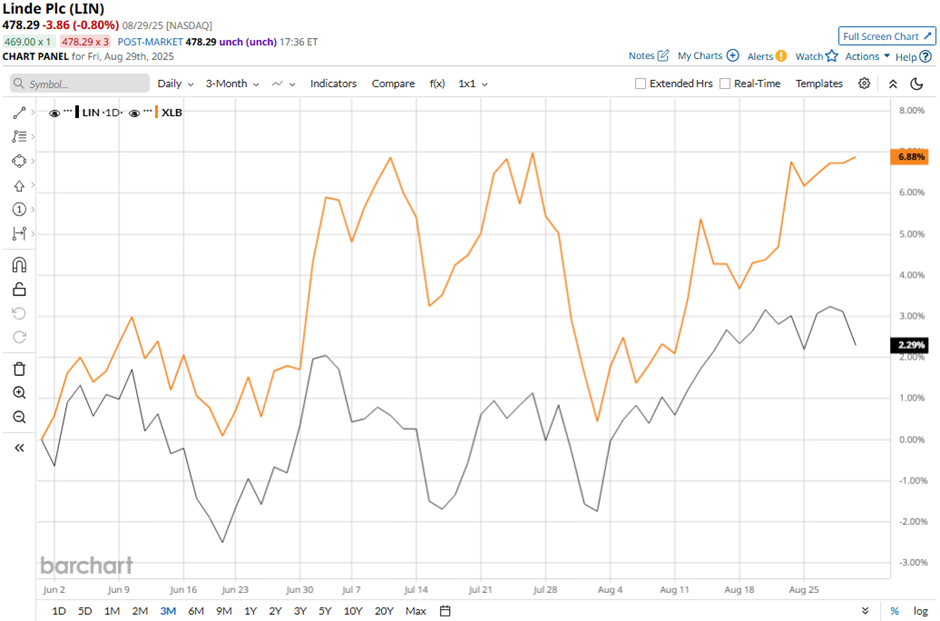

However, the Woking, the United Kingdom-based company stock has decreased 1.9% from its 52-week high of $487.49. Shares of Linde have risen 3.1% over the past three months, lagging behind the Materials Select Sector SPDR Fund's (XLB) 6.9% increase over the same time frame.

Longer term, LIN stock is up 14.2% on a YTD basis, outperforming XLB’s 9.7% gain. In addition, shares of the company have returned 1.2% over the past 52 weeks, compared to XLB’s marginal drop over the same time frame.

Linde stock has been trading mostly below its 50-day and 200-day moving averages since mid-May.

Despite Linde’s better-than-expected Q2 2025 adjusted EPS of $4.09 and revenues of $8.5 billion, shares fell marginally on Aug. 1. The Engineering segment’s operating profit fell to $90 million, missing the estimate, and the EMEA segment saw lower volumes in key end markets like metals & mining and manufacturing despite higher pricing.

Nevertheless, rival The Sherwin-Williams Company (SHW) has underperformed LIN stock. Shares of Sherwin-Williams have risen 1.1% over the past 52 weeks and 7.6% on a YTD basis.

Due to Linde’s outperformance, analysts are bullish about its prospects. The stock has a consensus rating of “Strong Buy” from the 26 analysts covering the stock, and the mean price target of $515.74 is a premium of 7.8% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.