Arista Networks Stock: Is ANET Outperforming the Technology Sector?

/Arista%20Networks%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

Based in Santa Clara, California, Arista Networks Inc (ANET) is a prominent player in cloud networking, offering cutting-edge solutions tailored for data centers and high-performance computing. The company delivers highly scalable and programmable Ethernet switching and routing platforms, widely adopted by industries such as cloud computing, finance, and media.

Arista’s hallmark is its Extensible Operating System (EOS), known for its reliability and automation capabilities, which enable seamless network management, advanced analytics, and enhanced security across both enterprise and cloud infrastructures.

Companies with a valuation above $10 billion are generally considered “large-cap” stocks. With a market capitalization of about $171.62 billion, Arista certainly fits right into this category. The company holds a leading position in the computer hardware industry, specializing in high-performance networking equipment for cloud data centers and enterprise environments.

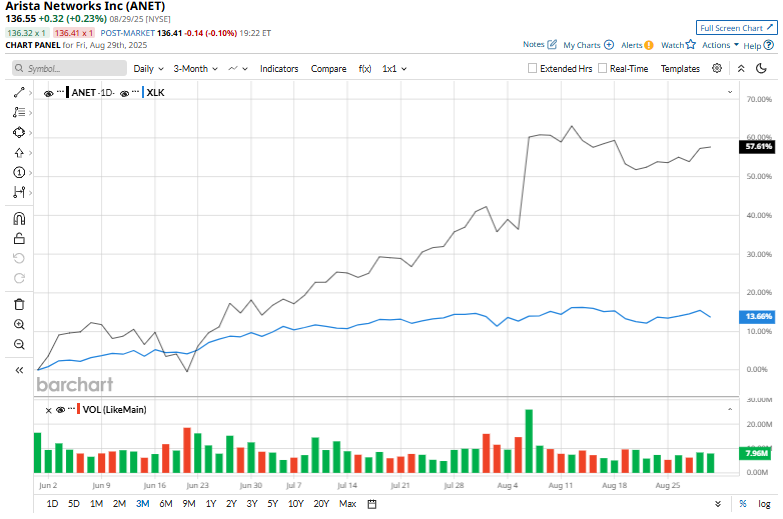

The company’s stock price has been shooting up recently. Over the past three months, Arista Networks’ shares have gained 58.1%. The stock had reached an all-time high of $141.99 in August and is only down 3.8% from this high. In contrast, the Technology Select Sector SPDR Fund (XLK) is up only 13.3% over the same period, which shows that the stock is an outperformer in its sector.

On a year-to-date (YTD) basis, Arista Networks’ stock has gained 23.5%, while over the past 52 weeks, it is up by 60.1%. In contrast, XLK gained 12.9% and 19.6% over the same periods, respectively.

Underscoring the strength of its recent surge, Arista Networks’ stock has consistently held above both its 50-day and 200-day moving averages since late June, a clear technical signal of sustained bullish momentum and investor confidence.

Arista Networks is riding the wave of significant investments in artificial intelligence (AI). Based on this surge in demand, the company reported solid second-quarter results. Its total revenue increased by 30.4% year-over-year (YOY) to $2.20 billion.

Its profitability is also in a good position, as its non-GAAP EPS of $0.73 is 37.7% higher than the prior year’s quarter and the analyst-expected consensus figure of $0.65. The success of Arista can be gauged by the fact that its non-GAAP operating income surpassed the $1 billion mark for the first time.

To hammer home the stock’s outperformance, we see that one of its top rivals, Cisco Systems, Inc. (CSCO), has gained 38.6% over the past 52 weeks and 16.7% YTD. While Cisco’s stock has posted solid gains, outperforming the tech sector, Arista Networks has been the better performer over this period.

Wall Street analysts are soundly bullish on Arista Networks’ stock, with more gains anticipated. The stock has a consensus rating of “Strong Buy” from the 24 analysts covering it, and the mean price target of $144.90 is at a premium of 6.1% compared to current levels. The Street-high price target of $175 places the stock firmly above its all-time high and indicates a 28.2% upside.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.