Will Silver Trade To $50 in 2025?

I asked if silver was on its way to a new and higher high in a July 18, 2025, Barchart article, concluding with:

If silver takes off and the price rises above the 1980 peak, it will further validate the decline in the value of fiat currencies. Gold has already surpassed the euro as the world’s second-leading reserve currency, as central banks continue to increase their gold holdings and validate gold as a reserve asset. Silver has a history dating back thousands of years to pre-Biblical times, as gold’s partner as a means of exchange or as hard money. A new high in silver will only exacerbate the decline in fiat currencies, which derive their value from the full faith and credit of the governments that issue legal tender and sovereign debt securities.

Silver could be on its way to new highs as fundamentals and technicals point to a challenge of the 2011 and 1980 highs. However, the decline in fiat money adds another dimension to silver’s potential in the current economic and geopolitical environment.

Nearby COMEX silver futures were at $38.55 per ounce in mid-July, after trading to a high of $39.57 on July 14. Silver made another higher high since that article, and has surpassed the $40 psychological level.

A higher high in late August

Silver prices moved above the $40 per ounce level in late August, when the December COMEX futures contract reached $40.86 on August 29.

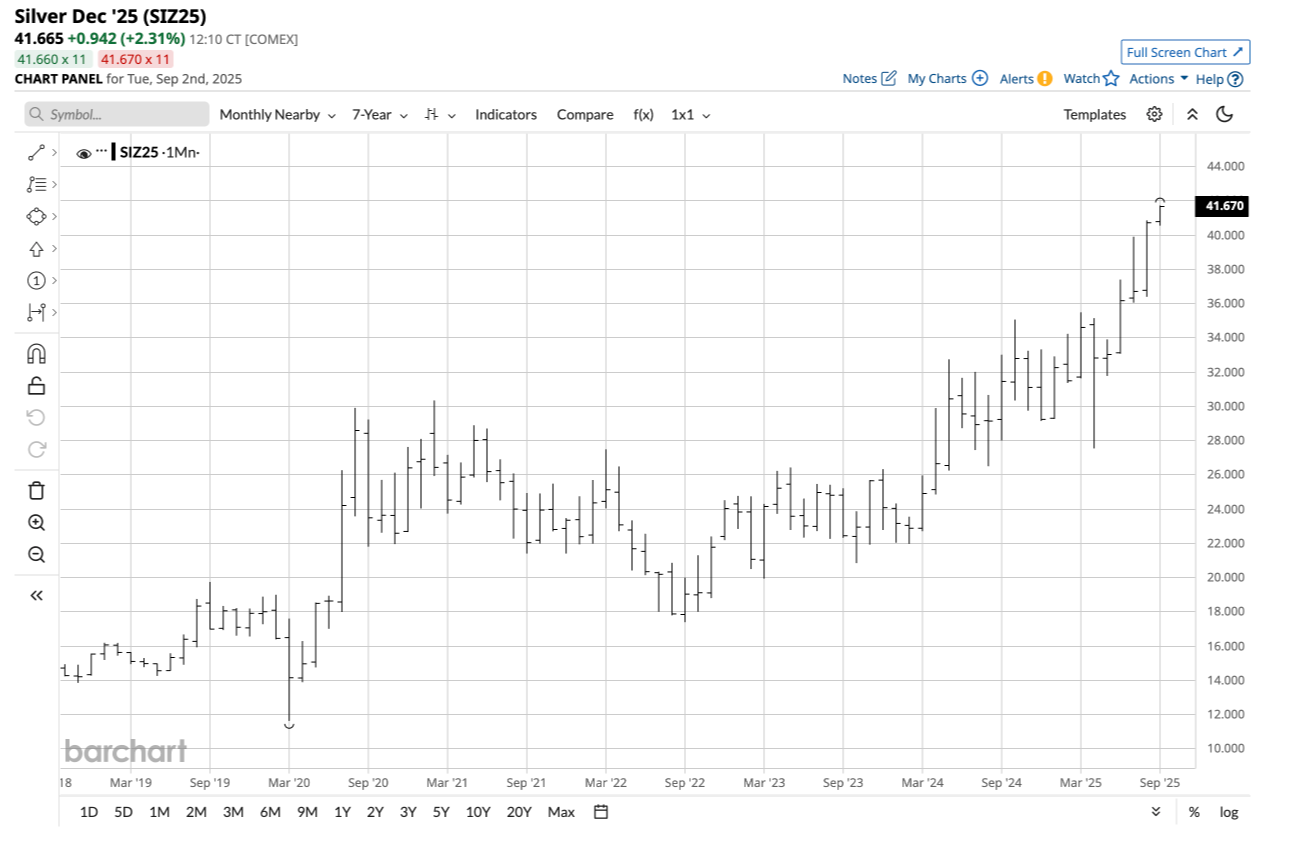

The medium-term seven-year monthly COMEX silver futures chart highlights the rise from the March 2020 pandemic-inspired low of $11.64 to the latest September 1, 2025, high of $41.73 per ounce.

Trending higher in 2025

Silver prices have increased by over 3.4 times since the 2020 low, with the bullish trend continuing in 2025.

The daily continuous COMEX silver futures chart highlights the 42.7% rally from the December 31, 2024, low of $29.242 to $41.73 per ounce in early September 2025.

The long-term chart is bullish

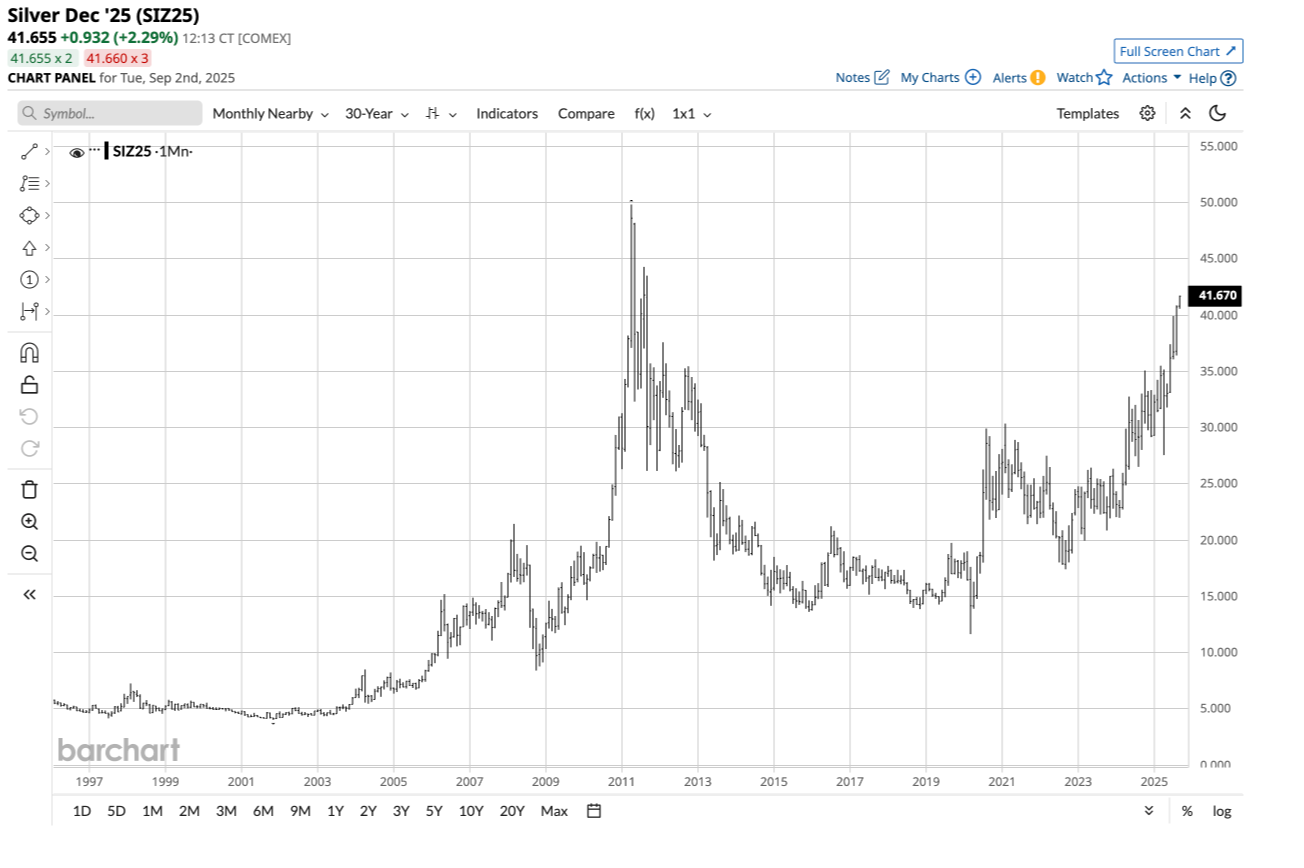

At the turn of the latest century, on December 31, 1999, nearby COMEX silver futures settled at $5.4130 per ounce. After trading as low as $4.02 in November 2001, silver prices rose steadily.

The thirty-year monthly continuous COMEX silver futures chart illustrates silver’s over twelve-fold increase from the low of November 2001, when silver’s price reached $49.82 in April 2011.

The monthly chart remains bullish, with silver trading above $41.60 in early September 2025.

$40 was not the target

The $40 level in silver was not a technical, but a psychological level.

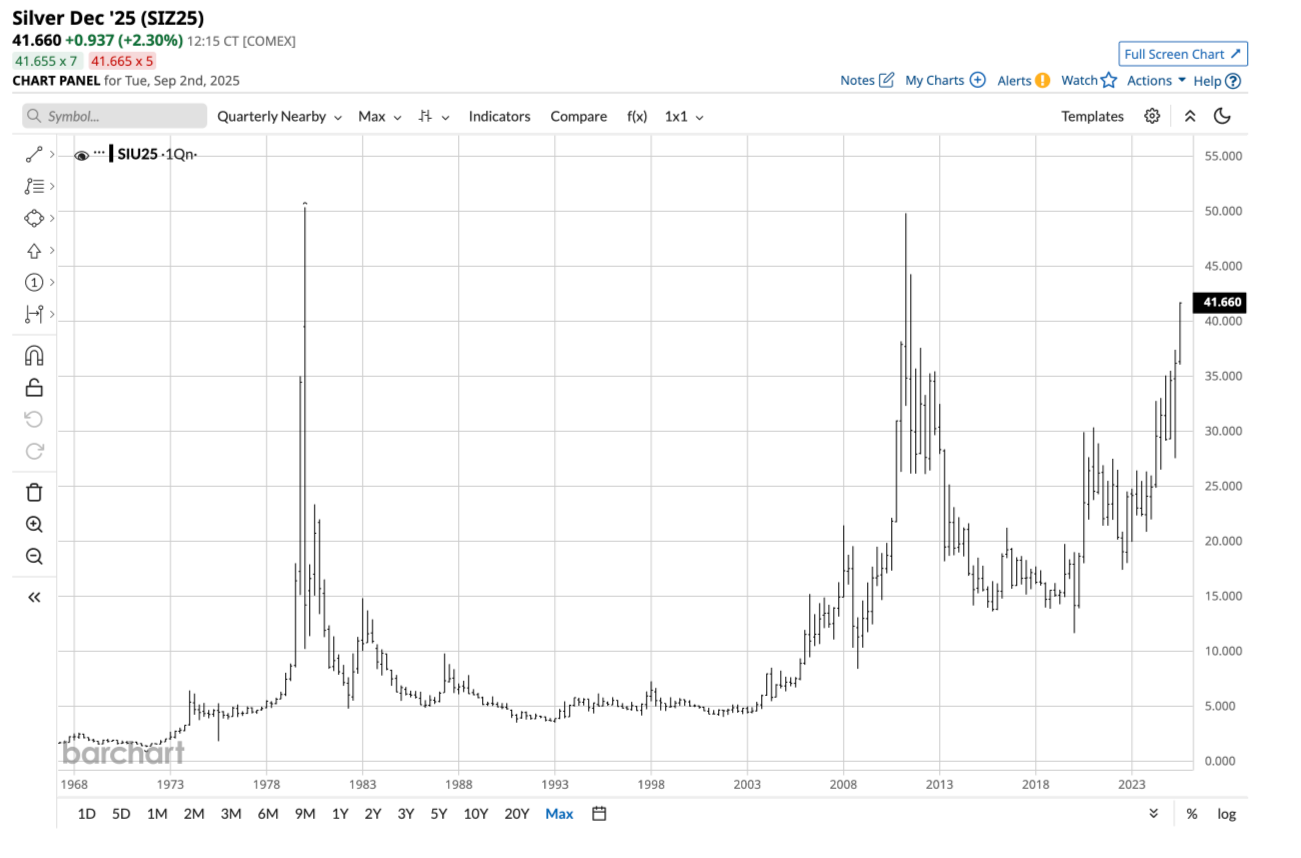

The quarterly chart from the 1960s shows that silver reached a record peak of $50.36 in 1980, and a slightly lower high of $49.82 in 2011, which are the ultimate upside technical targets. Meanwhile, the next technical hurdle to conquer is the Q3 2011 high of $44.275 per share.

Buying silver on price weakness has been optimal

While silver has made higher lows and higher highs since the March 2020 low, he price has not rallied in a straight line. Silver futures have experienced substantial periodic corrections, but these have not negated the bullish trend for over five years. Silver reached $30.35 in February 2021 before correcting 42.7% to a low of $17.40 in September 2022. The latest correction took silver prices 22.4% lower from $35.495 in March 2025 to a low of $27.545 the next month in April 2025.

Buying silver on a scale-down basis during price corrections has been optimal since March 2020, and I expect that trend to continue.

One of the most bullish factors underpinning the silver market is the precious metal’s price and value relationship compared to gold. Gold has reached new record highs for the past seven consecutive quarters.

The quarterly chart shows that the yellow metal has already reached its eighth consecutive record peak in Q3 2025.

The silver-gold ratio chart ({GCZ25}/{SZ25}) highlights the number of ounces of silver value in each ounce of gold value. After rising to a high of nearly 125:1 in Q1 2020, the ratio reached a lower peak of approximately 108:1 in Q2 2025. At around 85.127:1 in early September, the ratio has declined, indicating silver’s recent price strength and bullish trend as it has outperformed gold.

I believe silver will trade to the $50 level in 2025, challenging the 2011 and 1980 highs in 2026. Buying silver on price weakness has been optimal, and I expect that trend to continue.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.