Is Affirm Stock the Next Fintech Growth Story?

Despite the fintech industry being dominated by established giants like PayPal (PYPL), Block (XYZ), Visa (V), and Mastercard (MA), Affirm Holdings (AFRM) is quietly but steadily carving out its own path in the "buy now, pay later" (BNPL) space.

Affirm is a fintech company that focuses on BNPL services. Instead of using traditional credit cards, Affirm allows customers to break down purchases into smaller installments, sometimes with no interest and sometimes with clear, fixed interest rates, depending on the product and merchant. A strong end to fiscal 2025 sent its stock soaring 10% on Friday. So far this year, Affirm stock has risen 36%, outperforming the broader market.

Let’s find out if the stock is a good buy now.

Affirm’s Business Model Is Strong

Affirm's business model has proven successful across a diverse range of merchants, including fashion, electronics, and travel. Retailers benefit from higher conversion rates and larger average order sizes, while consumers gain greater payment flexibility in the absence of traditional credit card structures. What sets Affirm apart is its ability to secure and expand relationships with well-known merchants. Affirm's integration into checkout flows by companies such as Amazon (AMZN), Walmart (WMT), Apple (AAPL), and Shopify (SHOP) creates a moat for the company, lowering customer acquisition costs and increasing its visibility.

In the most recent fourth quarter, which ended June 30, Affirm's revenue increased 33% year-on-year (YoY) to $876 million. Gross Merchandise Volume (GMV) increased 43% to $10.4 billion during the quarter, reflecting increased use of Affirm's BNPL services. Affirm is increasingly being used by consumers outside traditional retail, indicating that its use cases are expanding. Active consumers increased to 23 million, up 24% YoY.

Affirm stated that 95% of transactions in the quarter came from repeat borrowers, reflecting trust and strong repayment performance. The company also stated that Affirm Card is becoming one of the most promising growth levers, with GMV reaching $1.2 billion and a 10% attach rate, which the company defines as “active cardholders divided by total active consumers during a given period.” The long-term vision for the Affirm Card remains ambitious, with the company expecting 10 million active cardholders and $7,500 in GMV per year.

According to CEO Max Levchin, many investors questioned whether Affirm would "survive the rising Fed funds rate, let alone turn a profit." Levchin boasted that “We didn’t just crush this quarter—we actually set a new record for most of our metrics.” He added, “Tell you that our growth is accelerating, and we are firing on old [sic] pistons.” The company reported a net profit of $69 million, compared to a net loss of $45 million in the year-ago quarter. In fiscal 2025, net revenue increased 38.7% YoY to $3.2 billion. Affirm also reported a net income of $52.2 million, compared to a net loss of $517.8 million in fiscal 2024.

During the Q4 earnings Q&A, Evercore ISI analyst Adam Frisch expressed concern about potential headwinds from resumed U.S. student loan repayments, which could tighten consumer budgets. Levchin emphasized that Affirm remains cautious in assessing borrower creditworthiness. When asked about the funding environment, CFO Michael Linford credited Affirm's emphasis on partnering with long-term, blue-chip capital providers who can be the company's reliable partners in the long run.

With strong repeat usage and disciplined credit management, Affirm enters fiscal 2026 with a strong lead. The challenge for Affirm now is to navigate an increasingly competitive field while showing that its growth trajectory can lead to long-term profitability. For fiscal 2026, analysts covering the stock expect revenue to increase by 23.3% to $3.9 billion, with earnings rising by 41.1%. Trading at 35 times forward earnings, AFRM stock is a tad bit expensive but also reflects investors' confidence in the company’s growth potential.

What’s Wall Street’s Take on AFRM Stock?

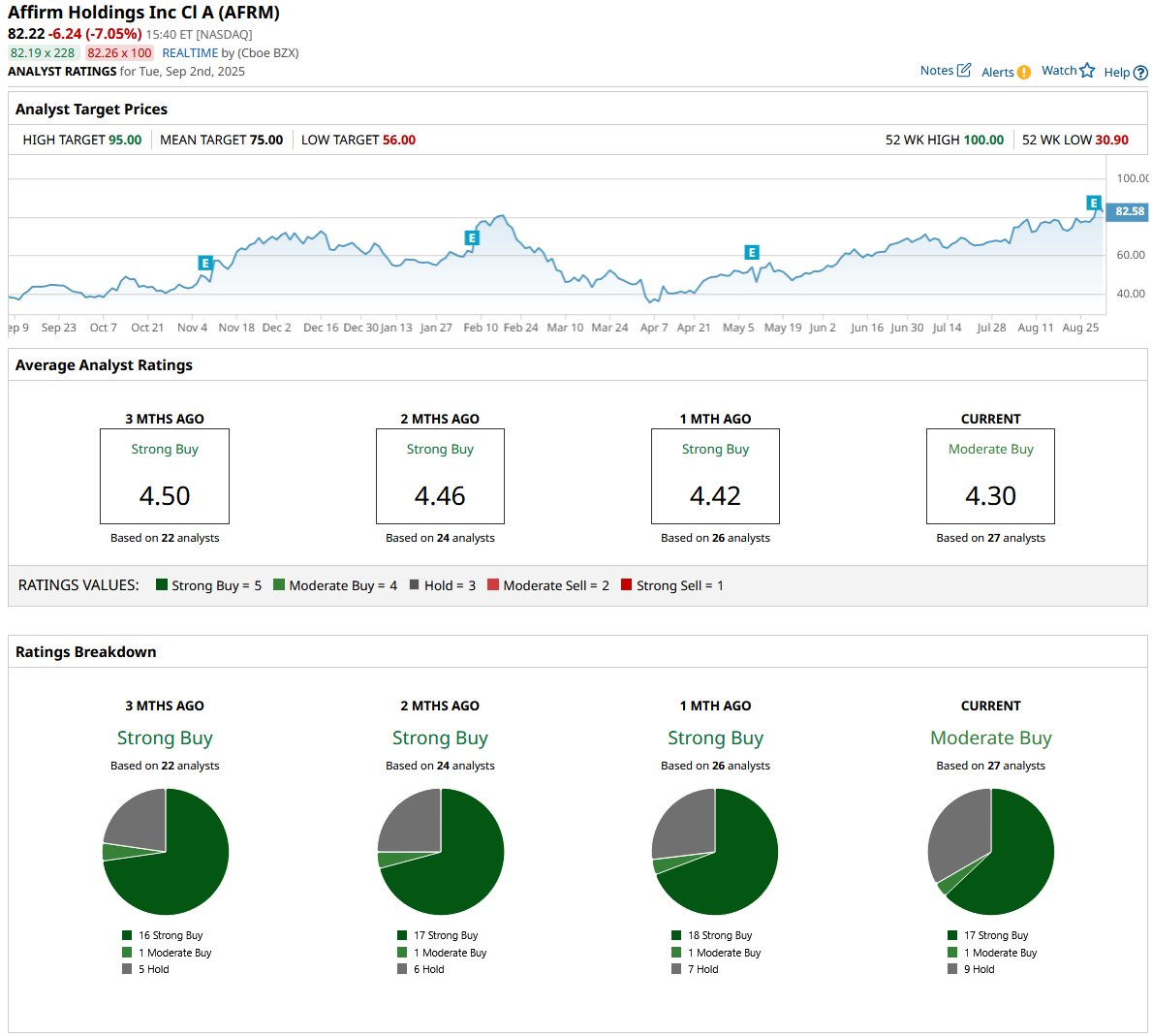

Overall, AFRM stock has a “Moderate Buy” rating on the Street. Out of the 27 analysts in coverage, 17 rate it a “Strong Buy,” one says it is a “Moderate Buy,” and nine recommend a “Hold.” Affirm stock has surpassed its mean target price of $75. However, its high price estimate of $95 indicates the stock could gain 16% in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.