Down 65% in 2025, Should You Buy the Dip in Krispy Kreme Stock?

Popular donut chain Krispy Kreme (DNUT) snagged a seat at the meme stock table earlier this summer, popping more than 25% in a single trading day in mid-July.

The rally had little to do with business performance and everything to do with viral momentum, as retail traders on Reddit (RDDT) and X declared the stock’s ticker “simple, catchy, and instantly memeable.” That mix of internet buzz and nostalgia was enough to ignite a buying spree. As with many meme-stock surges, the move was powered more by crowd psychology than company fundamentals.

Now, the buzz has all but died away, leaving DNUT shares down more than 65% in the year to date. Is this an opportunity to snag a yummy treat at a discount, or should you stay far away from Krispy Kreme here?

About Krispy Kreme Stock

Charlotte-based Krispy Kreme has become a household name among donut lovers worldwide. Best known for its melt-in-your-mouth Original Glazed doughnut, the company now operates in over 40 countries. Whether through local shops, grocery store partnerships, or its growing digital reach, Krispy Kreme continues to find new ways to deliver its treats to nearly 18,000 locations worldwide. The company’s market capitalization currently stands at about $607 million.

However, even with all the love for its donuts, Krispy Kreme’s stock has been losing its shine. As economic uncertainty weighs on wallets, many consumers are trimming back on non-essentials, including indulgent pick-me-ups like donuts and coffee. The dip in sales, combined with the end of its partnership with McDonald’s (MCD) in June, has only added to the pressure.

The company’s struggles are reflected in its price action. It’s been a rocky road for Krispy Kreme stock, with DNUT tumbling 70% over the past year and shedding nearly 67% year-to-date (YTD).

Krispy Kreme’s Fundamentals Aren’t So Sweet

Back in May, Krispy Kreme’s fiscal 2025 first-quarter earnings report disappointed investors, triggering a sharp 24.7% selloff on May 8. Revenue came in at $375.2 million, down 15.3% from the previous year and falling short of the consensus estimate of $381.2 million. In Q2, revenue of $379.8 million was down 13.8% year over year, continuing the pain.

The company also posted in Q2 that its adjusted loss per share widened dramatically from $0.05 per share to $0.15. The company sold its majority stake in Insomnia Cookies, and said it was undertaking an effort to maximize its U.S. expansion and become more capital light.

Plus, the company had announced following its Q1 results that it would halt its dividend payments. Talk about a bad aftertaste with that donut bite!

What Do Analysts Think About Krispy Kreme Stock?

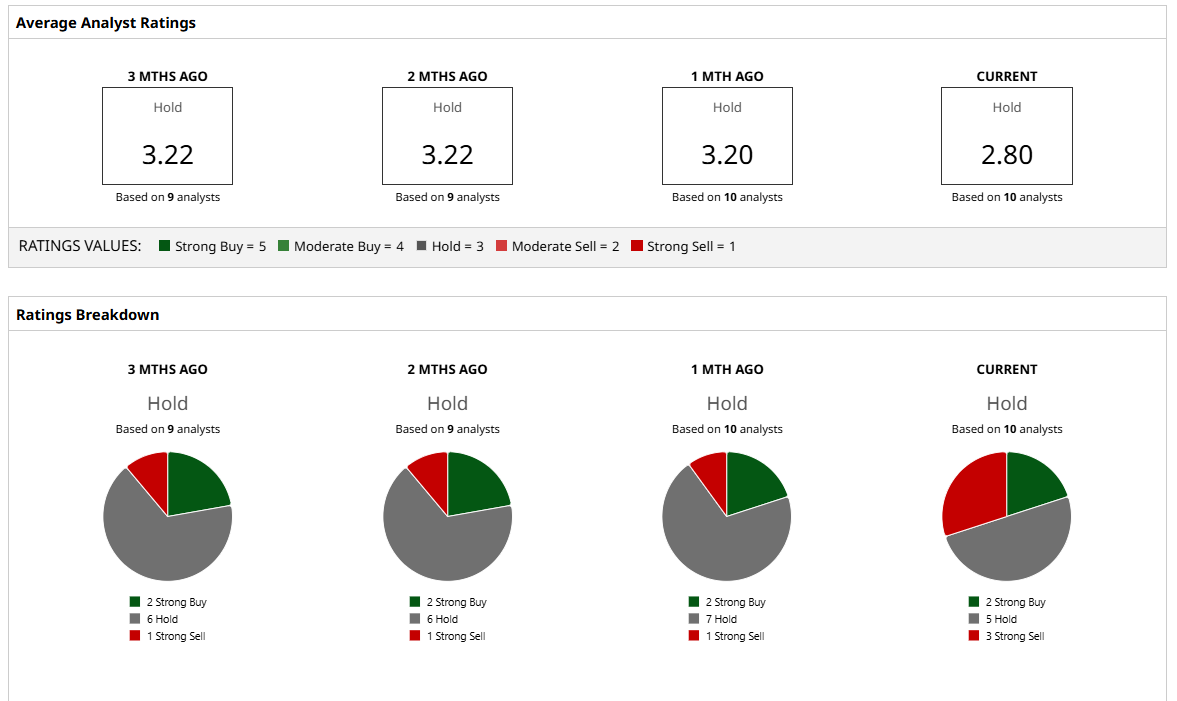

Overall, Wall Street’s appetite for Krispy Kreme stock remains measured. DNUT has earned a consensus “Hold” rating, reflecting a cautious stance from analysts. Of the 10 analysts covering the name, only two are going all in with a “Strong Buy,” while five are playing it safe with a “Hold,” and three are sounding the alarm with a “Strong Sell.”

DNUT’s average analyst price target of $6.33 suggests 89% potential upside from current levels, while the Street-high target of $14 implies that the stock can rally as much as 317% from current levels.

Key Takeaways

Krispy Kreme might have gotten some midsummer love from meme stock fans, but the numbers tell a more cautious tale, especially as the summer comes to an end.

With sales on the decline, quarterly dividends paused, and nearly $2 billion in debt weighing down its balance sheet, the stock’s recent hype seems out of step with reality.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.