1 ETF Worth Snapping Up Before September 4

Football season is finally at hand! The National Football League’s season kicks off on Sept. 4 when the defending champion Philadelphia Eagles host the Dallas Cowboys. For many, football season means weekend relaxation, good friends, cool drinks, amazing tailgating food, and screaming at the TV. But for others, this is a time to put down money with an online sportsbook—and U.S. bettors are expected to wager $30 billion this football season, which would be a new record.

Legalized sports wagering accounted for $115 billion in revenues in 2024, according to the American Gaming Association. Sports wagering is legal in 39 U.S. states, as well as Puerto Rico and the District of Columbia. Easy-to-navigate smartphone apps, prop bets, futures, and live betting provide various ways for gamblers to bet not only on who will win, but also on who may score a touchdown, record a sack, or how the next play will unfold.

For investors who are looking to capitalize on the proliferation of sports wagering, an exchange-traded fund (ETF) is the simplest way to invest in a basket of sports wagering stocks at the same time. That way, instead of guessing which company may do well and which may fail, you get instant diversification by getting a stake in all the sports wagering stocks at the same time.

About the BETZ ETF

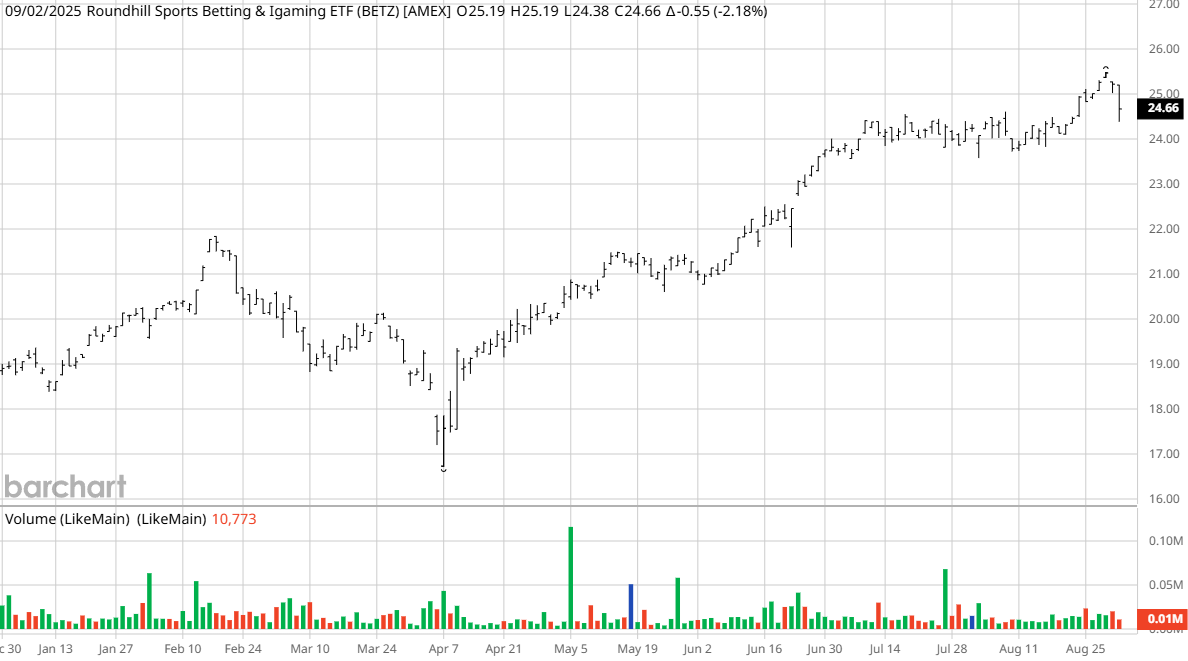

The Roundhill Sports Betting & iGaming ETF (BETZ) is a popular way to play the sports betting craze. The BETZ ETF, which is managed by Roundhill Investments, has $89.5 million in assets under management and has been trading since June 2020.

The BETZ ETF is having a mammoth year, up 30% so far in 2025 and 37% in the last 12 months. At a price at this writing of around $25, BETZ is trading close to its 52-week high of $25.52. Its performance by far outpaces the year-to-date (YTD) gains of the Nasdaq Composite’s ($NASX) 9.5% YTD gain and the 8.5% advancement of the S&P 500 ($SPX).

The BETZ ETF carries a management fee of 0.75%, or $75 annually for each $10,000 invested. As a passively managed fund, it tracks the performance of the Morningstar Sports Betting & iGaming Select Index (MSSBGSGU), which is up 33% so far in 2025.

What Stocks Are in the BETZ ETF?

The Roundhill Sports Betting & iGaming ETF currently has 29 stocks, with the top five names making up 35.7% of the portfolio. They include:

Flutter Entertainment (FLUT): The heaviest weighting of 9%, Flutter is the parent company of U.S. sports wagering site FanDuel. But it also owns companies such as Sky Betting & Gaming, which operates in the U.K., and Sportsbet, an online site for wagering on horse races. Flutter also owns online gaming platforms like Paddy Power and PokerStars, giving investors plenty of diversity.

Lottomatica Group (LOTMY): The Italian company makes slot machines and other gambling technology. It connects thousands of gaming terminals throughout Italy and also manages online sports wagering sites such as Lottomatica, Better, and Goldbet. It has a 7.9% weighting in BETZ.

DraftKings (DKNG): Competing head-to-head with FanDuel in the U.S., DraftKings operates an online gaming platform in states where sports gaming is legalized in the U.S. It has a weighting of 6.5% in the BETZ ETF.

Genius Sports (GENI): This London-based company provides the infrastructure for sports wagering as well as tools to provide team analytics. The company uses its big data and artificial intelligence (AI) platform, GeniusIQ, to provide teams with data points that can be used to create metrics that track player performance. Its platform also provides live data, in-game betting odds, and AI-augmented broadcasts for sports wagering platforms and in-game betting opportunities. It has a weighting of 6.3% in the BETZ ETF.

Super Group (SGHC): Based in the Channel Islands off the coast of Western Europe, Super Group operates as a holding company for various online sports wagering sites, including global sportsbook Betway. It also has several companies that provide casino-style wagering with games including slots and table games. Super Group has a 6% weighting.

Why Choose the BETZ ETF?

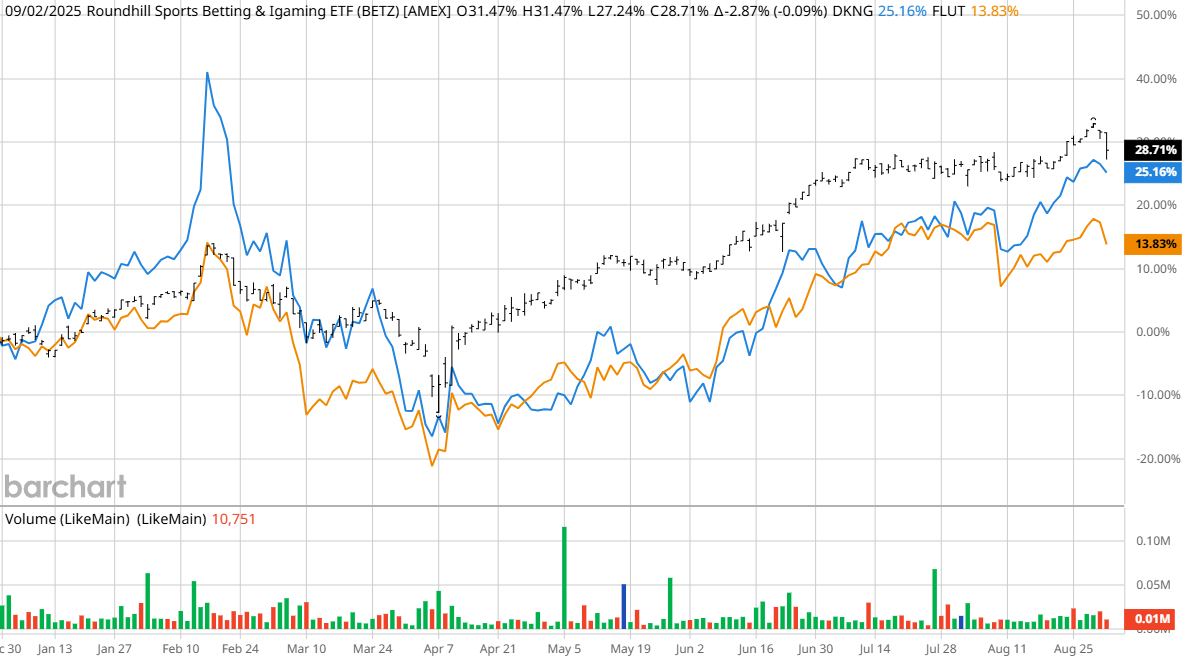

While many components of the BETZ ETF are not involved directly in NFL wagering, the exchange-traded fund is still a compelling choice for investors. Its YTD performance is better than the top two companies primarily involved in NFL bets, DraftKings and Flutter.

Investors who are looking for a creative way to capitalize on the expected record volume of NFL betting this year would be well-served to take advantage of the outsized performance and additional diversification that comes with the BETZ ETF.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.