Is Microchip Technology Stock Underperforming the Nasdaq?

/Microchip%20Technology%2C%20Inc_%20HQ%20sign-by%20Michael%20Vi%20via%20Shutterstock.jpg)

Microchip Technology Incorporated (MCHP) is not just another semiconductor name, but a quiet powerhouse shaping the connected world. Headquartered in Chandler, Arizona, the company designs, manufactures, and sells smart, secure embedded control solutions across America, Europe, and Asia.

Its sprawling portfolio serves 120,000+ customers in industries ranging from automotive and industrial to aerospace, defense, communications, and computing. With a $35.1 billion market capitalization, Microchip stands tall in a fiercely competitive chip landscape, balancing innovation with scale.

On Wall Street, “large-cap stocks” are the market’s anchors - companies worth $10 billion or more that command influence and investor confidence. Microchip Technology fits the mold, leveraging its scale to ride semiconductor cycles with resilience. With strong exposure to artificial intelligence (AI), aerospace, and defense trends, MCHP quietly powers critical innovations, making it a heavyweight that shapes the tech landscape while delivering steady performance.

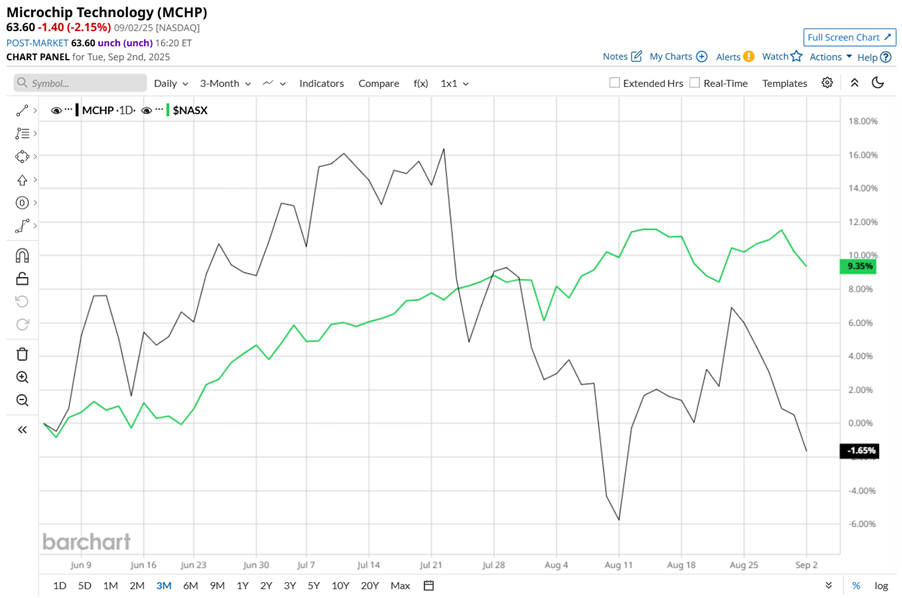

MCHP stock’s journey has not been smooth. After hitting a 52-week high of $81.64 on Sept. 27, the stock has since plunged 22.1%, reflecting pressure from a choppy semiconductor market. Yet, there has been a recent glimmer of strength - MCHP has climbed 6% over the past three months, though it still trails the Nasdaq Composite’s ($NASX) 10.6% uptick in the same period.

Zooming out, the past 52 weeks tell a tougher story, with semiconductor stock sliding 22.6%, while the tech-heavy Nasdaq surged 20.1%. Interestingly, 2025 has started brighter - shares of Microchip are up 10.9% on a year-to-date (YTD) basis, slightly edging past NASX’s 10.2% gains.

MCHP stock momentum has reflected a period of dynamic trend shifts. For most of the past year, shares languished below both the 50-day and 200-day moving averages, reflecting persistent weakness. But since May, bulls regained control, pushing MCHP above its 50-day MA and sustaining a rally above the 200-day MA by June. However, the tide turned in early August – its shares slipped back under the 50-day line while still holding above the 200-day, signaling mixed but stabilizing technical momentum.

Microchip Technology has been riding the semiconductor sector’s turbulence like a pro. Over the past year, the entire chip space stumbled - tariff noise, bloated inventories, and weak auto and industrial pull-ins dragged MCHP stock deep into the red. But early 2025 flipped the script. March marked the bottom after seven straight quarters of inventory declines, which finally stabilized.

Then came a breakout Q4 on May 8, following which shares of Microchip Technology climbed 12.6%. Top and bottom lines beat Wall Street estimates. Then on Aug. 7, the company released Q1 2026 earnings report, with a 10.8% sequential sales surge to $1.075 billion, the strongest July bookings in three years, and a book-to-bill ratio holding above 1.0.

Momentum accelerated with design wins across aerospace, defense, AI, and data center infrastructure, where Microchip is making serious inroads. Roughly 50% domestic wafer fabrication provided a strategic edge amid geopolitical tensions, while AI-driven tools boosted microcontroller productivity by up to 40%.

But Wall Street’s expectations cut deep. Q1 2026 results beat guidance, yet weren’t “strong enough,” and the stock dipped over 6% in the subsequent trading session. Inventory write-offs, $51.5 million in underutilization charges, and a net debt-to-adjusted EBITDA ration of 4.22x kept bulls cautious. Despite strong margins and AI tailwinds, investors dumped the stock, proving once again that on Wall Street, even good is not always good enough.

MCHP stock has lagged behind its industry peer Micron Technology, Inc.’s (MU) 40.8% YTD surge and 23.1% rally over the past year.

Yet, the sentiment around Microchip remains notably upbeat. Among the 24 analysts covering the MCHP stock, the consensus rating is a “Strong Buy.” As of writing, the mean price target of $77.39 implies that the chip stock could rally by as much as 21.7%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.