Wall Street Thinks This Lesser-Known AI Stock Can Surge Nearly 50% From Here

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

Marvell Technology (MRVL) reported a strong second quarter for its fiscal 2026, showing how artificial intelligence (AI) has become the company’s defining growth engine. Marvell is a semiconductor company that creates and sells chips and infrastructure solutions for data storage, networking, cloud computing, 5G, AI, and automotive applications.

Despite two strong quarters in fiscal 2026, Marvell stock is down 43% year-to-date, trailing the broader market gain of 8.9%. With the data center business expanding and management highlighting long-term market opportunities, the question is whether Marvell can maintain momentum and convert AI tailwinds into long-term returns this year. Let’s find out.

Strong Q2 Performance Anchored by AI

In the second quarter, Marvell reported revenue of $2 billion, a remarkable 58% year-over-year surge. Notably, data center revenue increased 69% year on year to $1.49 billion, driven by custom XPU and XPU attach products, as well as an electro-optics interconnect portfolio. It accounted for 74% of total revenue, indicating how decisively Marvell has shifted its portfolio toward AI and cloud opportunities. Adjusted earnings increased by 123% to $0.67 per share, highlighting Marvell’s ability to translate top-line momentum into bottom-line growth.

During the quarter, Marvell completed the $2.5 billion sale of its automotive Ethernet business. The goal of this divestiture is to reduce exposure to slower-growing, non-data center markets while focusing capital and resources on the rapidly expanding demand for cloud and AI infrastructure.

While Data Center dominates Marvell’s growth story, other segments also made significant contributions. Enterprise Networking and Carrier Infrastructure generated a combined revenue of $324 million, representing a 43% year-over-year increase. Consumer End Market revenue of $116 million increased 30% year on year, driven by gaming demand. Automotive & Industrial revenue of $76 million remained flat year on year. With the automotive Ethernet divestiture completed, this segment will no longer be a key driver of growth.

Beginning with the fourth quarter, the company will divide its end markets into two categories: Data Centers, and Communications and Others. The latter is a new consolidated category that includes enterprise networking, carrier infrastructure, consumer, and industrial businesses. This decision is intended to streamline its business operations, with the four end markets now accounting for only 26% of total revenue.

Another interesting highlight in the quarter was the company’s bold expansion of its total addressable market (TAM) for data centers, which is now projected to reach $94 billion by 2028, a 26% increase over previous estimates. Marvell intends to increase its market share from 13% of $33 billion in 2024 to 20% of $94 billion in 2028. The company expects this expansion to be driven by 18 multi-generational custom XPU and XPU attach design wins, many of which are already in volume production. Furthermore, 50 new pipeline opportunities representing $75 billion in potential lifetime revenue and multibillion-dollar lifetime revenue potential from newly added sockets since June could contribute to this growth. Marvell’s combination of silicon design expertise and system-level integration puts it in a good position to meet this demand.

Capital Allocation Strategy Is Appealing

Marvell's capital allocation framework emphasizes a balance between investing in next-generation AI platforms and returning capital to shareholders, a strategy that should appeal to both growth and income investors. The company paid out $52 million in dividends in the second quarter and has repurchased $540 million in shares this year. It still has $2 billion in authorization, allowing it to pursue aggressive buybacks alongside growth investments. The company has actively managed its capital structure, including repaying debt with proceeds from a $1 billion note offering. It ended the quarter with debt of $4.5 billion and cash and equivalents of $1.2 billion.

With hyperscalers rapidly scaling their AI infrastructure and Marvell uniquely positioned across custom silicon, optics, and switching, the company is establishing both momentum and a solid foundation for the future. Management expects data center revenue to increase 30% year-over-year in Q3. Over time, Marvell sees a massive “scale-up” opportunity as AI data centers require ultra-low latency, multi-terabit interconnects to link thousands of XPUs. Total revenue could rise by 36% to $2.06 billion, with adjusted earnings rising by 72% at the midpoint to between $0.69 and $0.79 per share.

For fiscal 2026, analysts expect a 41.1% increase in revenue, followed by a 78.3% increase in earnings. In fiscal 2027, revenue and earnings growth are expected to increase by 16% and 21.2%. Trading at 22 times forward earnings, Marvell is still a great semiconductor stock to buy now with outstanding long-term growth potential.

What Are Analysts Saying About MRVL Stock?

Following the earnings, William Blair analyst Sebastien Naji maintained his “Buy” rating on Marvell stock. Naji believes investors who are patient will reap rewards as Marvell's diverse programs ramp up. Despite some near-term volatility, Marvell is an appealing long-term investment due to its expanding product reach, increasing customer adoption, and a large AI-driven TAM.

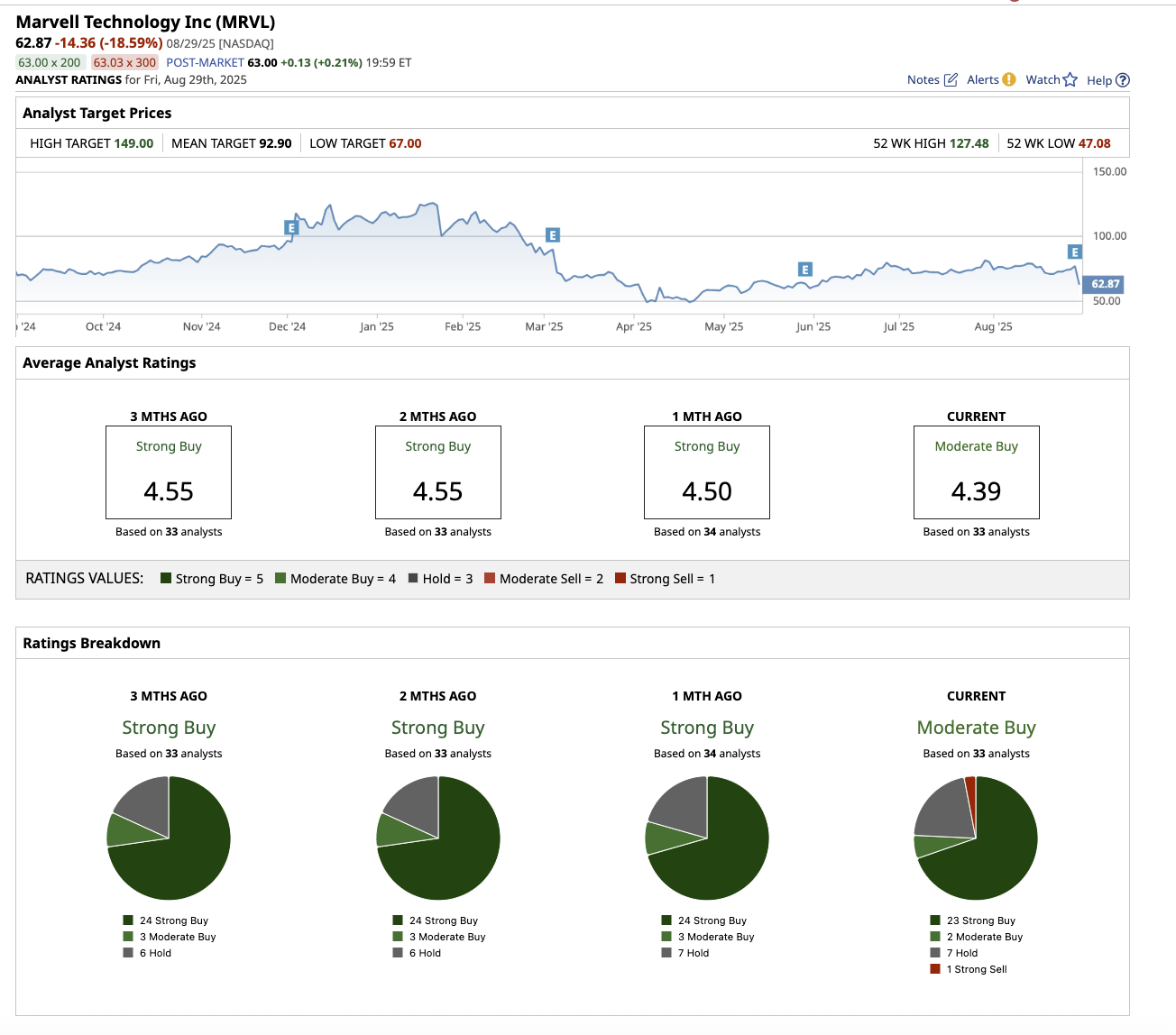

Overall, analysts are optimistic following a strong second quarter, rating the stock a “Strong Buy.” Out of the 33 analysts covering MRVL, 23 have rated it a “Strong Buy,” two have a “Moderate Buy” recommendation, seven suggest a “Hold,” and one says it is a “Strong Sell.” The average price target for MRVL stock is $92.90, which implies potential upside of 48% from current levels. Additionally, its high target price of $149 implies potential upside of 137% in the next 12 months.

The Bottom Line on Marvell Stock

If Marvell can continue to scale its AI offerings faster than other businesses’ cyclical declines, it has the potential to deliver significant upside. The company’s deep hyperscaler partnerships, diverse AI portfolio, and disciplined execution give it a real chance to turn today’s AI tailwinds into long-term growth.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.