How Is Capital One Financial’s Stock Performance Compared to Other Financial Services Stocks

/Capital%20One%20Financial%20Corp_%20bank%20exterior-by%20Brett_Hondow%20via%20iStock.jpg)

Capital One Financial Corporation (COF), headquartered in McLean, Virginia, is a major U.S. financial services player, specializing in credit cards, consumer lending, and auto loans. With a business model blending traditional banking and digital innovation, Capital One generates revenues from interest income, transaction fees, and customer spending.

Serving consumers and small businesses, it has built one of the largest credit card portfolios in the U.S., positioning itself as a powerhouse in personal finance and lending. Today, Capital One boasts a market capitalization of $142.8 billion.

“Large-cap stocks” are companies valued at $10 billion or more, and Capital One easily fits the bill with a market cap north of that mark. Founded in 1988, the financial giant has built a powerhouse reputation in credit cards, consumer lending, and auto loans. Its dominance in the U.S. credit card market, massive customer base, and diversified financial services portfolio have fueled its climb. Add in steady earnings, smart buybacks, and a strong balance sheet, and it’s no surprise Capital One sits comfortably in large-cap territory.

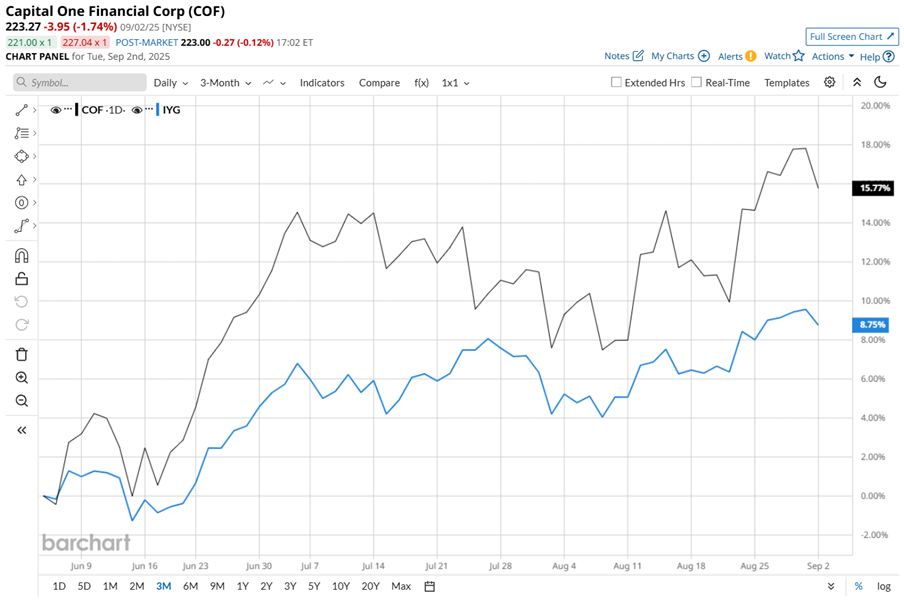

Capital One’s shares hit a 52-week high of $232.45 on July 23 following its Q2 2025 earnings results. It is currently down just 4% from those highs. Over the past three months, the stock surged 16.6%, outpacing the iShares U.S. Financial Services ETF’s (IYG) 8.6% rally in the same stretch.

Pull the lens back further, and the momentum only sharpens. Over the past year, shares of Capital One rose 52%, while IYG just climbed 24.1% over the same time frame. Moreover, COF stock climbed 25.2% on a year-to-date (YTD) basis, outpacing IYG’s 14.4% rally in 2025.

Technically, COF is in a sweet spot. Since April, the stock has traded comfortably above both its 50-day and 200-day moving averages, underscoring strong bullish momentum. With investors cheering its earnings strength and strategic moves, COF stock continues to ride a solid wave of confidence.

Capital One has been riding strong momentum, fueled by higher interest rates and robust credit card demand. Elevated net interest income (NII) and expanding net interest margin (NIM) have powered its earnings, while its strategic focus on consumer lending and digital banking continues to pay off. The company’s solid balance sheet and consistent dividend, restored to $0.60 per share since 2021, further strengthen investor confidence.

The lender’s shareholder-friendly stance adds another layer of appeal. Capital One authorized a $10 billion share repurchase program. Its blockbuster acquisition of Discover has also reshaped the competitive landscape, making Capital One the largest U.S. credit card issuer by balances. These moves have positioned the company as a dominant force in personal finance and lending.

Investors rewarded the credit card issuer and bank following its Q2 2025 earnings results, sending shares up 2.5% after adjusted EPS of $5.48 and revenue of $12.5 billion topped Wall Street expectations. While heavy marketing and tech spending, along with some pressure in auto lending and consumer spending, remain near-term hurdles, Capital One’s earnings strength and strategic scale-ups keep its stock comfortably trading in the green.

In the financial services industry, Capital One’s stock story has been a bit of a paradox. In 2025, it managed to outpace Discover Financial Services' (DFS) 15.5% gains on a YTD basis. Yet over the past 52 weeks, it lagged behind DFS’ blistering 60.3% rally.

Still, Wall Street’s tone is shifting and turning more optimistic. Among the 24 analysts covering the stock, the consensus rating stands at a “Strong Buy,” and that’s an upgrade from a “Moderate Buy” rating two months ago. Meanwhile, the mean price target of $251.86 hints at a potential upside of 12.8% from current levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.