Is General Dynamics Stock Outperforming the S&P 500?

/General%20Dynamics%20Corp_%20logo%20on%20phone-by%20madamF%20via%20Shutterstock.jpg)

Reston, Virginia-based General Dynamics Corporation (GD) operates as a global aerospace and defense company, specializing in high-end design, engineering, and manufacturing of weapons. With a market cap of $87.3 billion, GD’s offerings include ship construction, land combat vehicles, weapon systems & munitions, and more.

Companies worth $10 billion or more are generally described as “large-cap stocks.” GD fits this bill perfectly. Given the company’s extensive operations and dominance in the defense sector, its valuation above this mark is unsurprising.

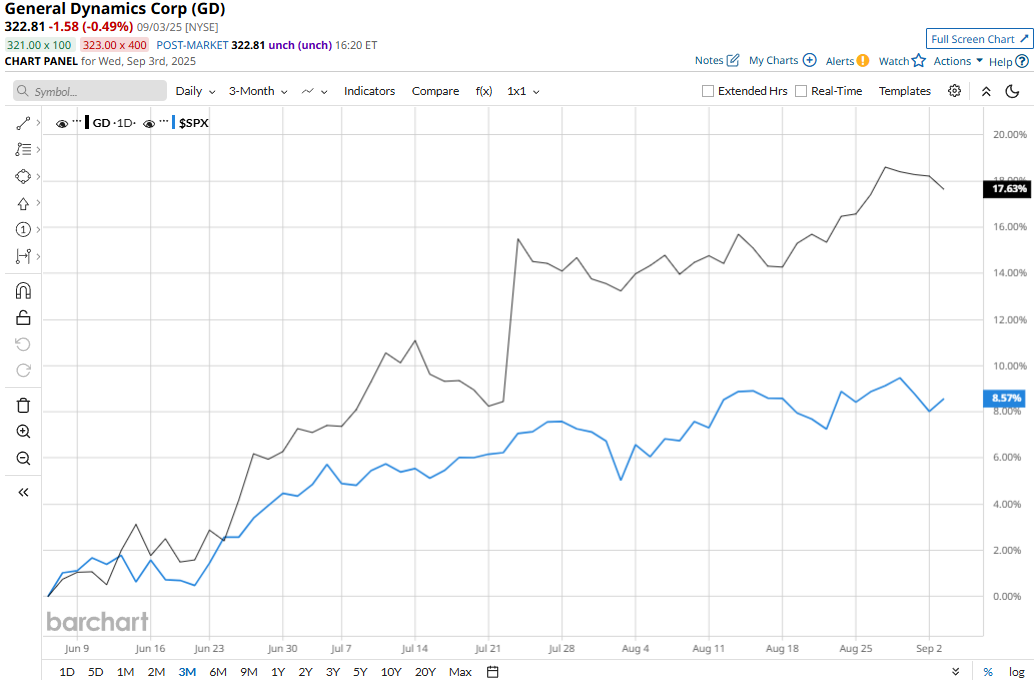

The stock touched its all-time high of $326.02 on Jul. 28 and is currently trading 1% below that peak. Meanwhile, GD stock prices have surged 16.9% over the past three months, notably outperforming the S&P 500 Index’s ($SPX) 8% uptick during the same time frame.

Over the longer term, GD stock prices have soared 22.5% on a YTD basis and gained 9.5% over the past 52 weeks, outperforming SPX’s 9.6% gains in 2025 but underperforming SPX’s 16.6% surge over the past 52 weeks.

To confirm the recent bullish trend, GD stock has traded mostly above its 50-day moving average since early March, with some minor fluctuations, and consistently above its 200-day moving average since mid-June.

General Dynamics’ stock prices gained 6.5% in a single trading session following the release of its impressive Q2 results on Jul. 23. The first half of 2025 has been marked with a companywide margin expansion, supported by solid growth in revenues and earnings across all its segments. Moreover, GD’s robust cash flows and backlog position it to drive further growth in the second half of the year.

GD’s overall revenues for the quarter came in at $13 billion, up 8.9% year-over-year and 5.6% ahead of the Street’s expectations. Meanwhile, the company’s EPS soared 14.7% year-over-year to $3.74, surpassing the consensus estimates by 4.2%.

However, GD has slightly underperformed its peer, Northrop Grumman Corporation’s (NOC) 23.8% surge on a YTD basis and 11.2% gains over the past 52 weeks.

The stock maintains a consensus “Moderate Buy” rating among the 23 analysts covering it. As of writing, GD’s mean price target of $334.15 represents a modest 3.5% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.