Is Alibaba Stock a Buy, Sell, or Hold for September 2025?

/Alibaba%20by%20testing%20via%20Shutterstock.jpg)

Chinese multinational technology company Alibaba (BABA) built its empire on e-commerce dominance, reshaping how China shops online. But 2025 has not been a straight climb for BABA stock. After peaking in mid-March, shares stalled, weighed down by trade tensions, U.S. restrictions on artificial intelligence (AI) chip exports, and lingering questions about China’s economy.

Then came Q1 — and a sharp turn. Alibaba stock soared 13% after blowout cloud results and growing excitement around the firm's new custom AI chip, designed to bypass Nvidia (NVDA) curbs and power a wave of innovation. Add to that Alibaba's aggressive bets on China’s cutthroat “instant commerce” market, and investors are finally warming up again.

With cloud growth accelerating and AI ambitions expanding, BABA stock is now trading at its highest levels since March. But with September here, is the stock your next big buy? Or is it time to cash out?

About Alibaba Stock

Alibaba has transformed into a tech titan, reshaping China’s digital landscape, now valued at a market capitalization of $330 billion. Founded by Jack Ma in 1999, the company now dominates e-commerce through Taobao, Tmall, and Alibaba.com while expanding into cloud computing, AI, fintech via Ant Group, and logistics through Cainiao.

Alibaba's bets on AI infrastructure and “instant commerce” are redefining its edge, placing it firmly among global tech heavyweights. After years of regulatory turbulence, the company’s resurgence is drawing fresh investor attention worldwide.

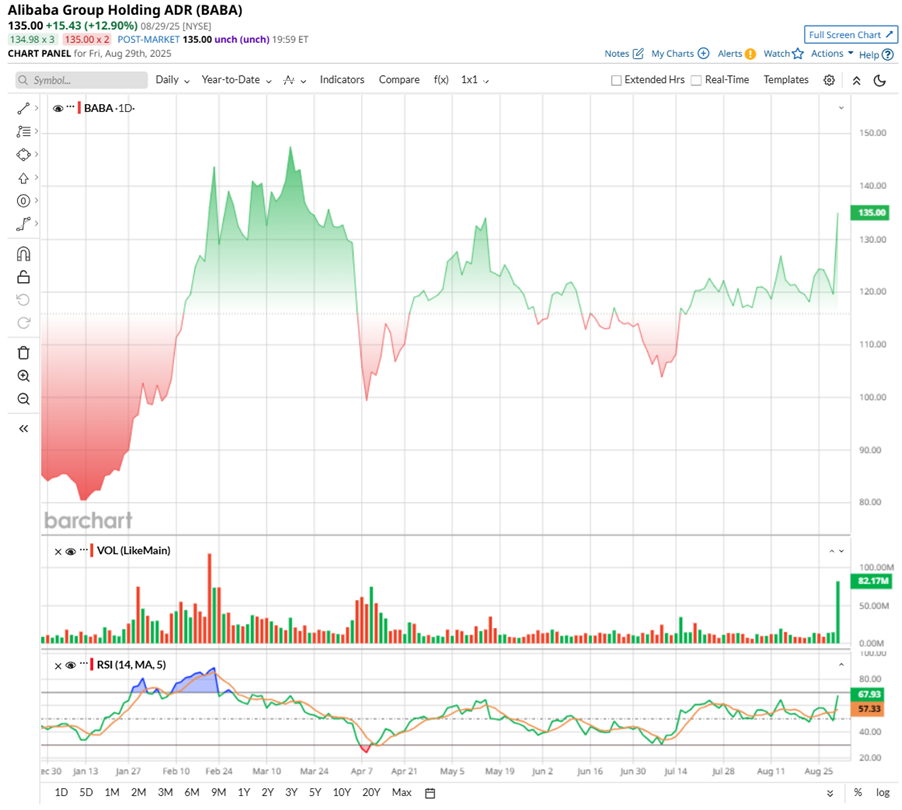

That resurgence is playing out in BABA stock's price action. Starting 2025 in the $80 range in January, the stock rocketed to a 52-week peak of $148.43 by March before sliding to $95.73 in April.

But momentum is back. Up 61% year-to-date (YTD) and returning 66% over the past 52 weeks, BABA stock closed at $135 after a 13% jump on Aug. 29, fueled by blowout first-quarter cloud results and excitement over its custom AI chip. Trading volume spiked to 82.17 million while the 14-day RSI climbed to 67.93, flashing bullish momentum. Investors are betting on Alibaba’s AI-powered growth story — and September could be the real test.

Alibaba is priced at just 17.2 times forward earnings, trading below the industry median. With analysts projecting double-digit profit growth next fiscal year, this discount looks less like weakness and more like a rare entry point before the market wakes up to BABA’s upside.

Alibaba Jumps Despite Mixed Q1 Report

On Aug. 29, Alibaba dropped its Q1 earnings, and the market reaction was anything but boring. Shares of the Chinese tech giant gapped higher, even though the results were a mixed bag.

For the quarter, adjusted earnings fell 10% year-over-year (YOY) to RMB 14.75 per American depositary share (ADS), missing forecasts. Revenue climbed a modest 2% to RMB 247.65 billion ($34.6 billion) — also shy of estimates. On the surface, it looked underwhelming. But things get interesting: net income skyrocketed 78%, thanks to gains from equity investments and the disposal of its stake in Turkish e-commerce firm Trendyol. Investors love profits, even when they come from clever maneuvers.

The real star of the quarter was Cloud Intelligence. Revenue there surged 26% YOY to RMB 33.4 billion ($4.7 billion), beating expectations and accelerating from the previous quarter’s growth. Alibaba credited AI adoption for the boost, signaling that it wants to be China’s Microsoft (MSFT) or Alphabet (GOOGL) in the AI race.

The company reported triple-digit growth in AI-related products for the eighth-straight quarter and pledged to spend $50 billion over the next three years on AI infrastructure. CEO Eddie Wu called AI a “significant” driver for cloud revenue going forward.

E-commerce, accounting for over 50% of Alibaba’s revenue, delivered mixed results. China's e-commerce revenue rose 10% to RMB 140.1 billion ($19.5 billion), while the international unit jumped 19%, driven by AliExpress and other platforms.

However, adjusted earnings in the core commerce division fell 21%, due to heavy investments in instant commerce — Alibaba’s bold bet on delivering products within an hour via Taobao. Competition here is brutal, with Meituan (MPNGY) and JD.com (JD) in the ring, but Alibaba’s management sees this as a trillion-yuan gross merchandise value (GMV) opportunity in three years.

Alibaba is not just betting on cloud growth — it is building its own AI chip to sidestep U.S. restrictions on Nvidia’s high-end processors. With Washington tightening export curbs and Beijing quietly urging companies not to buy even Nvidia’s older models, Alibaba’s move feels like both defense and offense.

The chip, still in testing, is designed for a wide range of AI tasks, from training large models to powering retail operations. It ties directly into Alibaba’s Qwen AI models and its larger push to weave AI across e-commerce and cloud. For China’s largest cloud provider, developing homegrown chips could ease geopolitical headwinds, reduce dependency on foreign tech, and sharpen its competitive edge in the AI arms race.

Analysts tracking Alibaba expect its earnings path to look like a dip before a rebound. Fiscal 2026 profits are projected to dip 5% YOY to $7.83 per share, then climb by 25% to $9.81 per share in fiscal 2027.

What Do Analysts Expect for Alibaba Stock?

Wall Street is turning bullish on Alibaba after Q1, with analysts hiking price targets on confidence in its cloud growth and expanding AI ambitions. CFRA kept a “Buy” rating, with analyst Angelo Zino stating that Alibaba’s investments in quick commerce and AI are reshaping its operations and positioning it for long-term gains.

Meanwhile, BofA Securities also lifted its price target to $152 from $135, citing triple-digit AI revenue growth for eight consecutive quarters and rising cloud investments. With management committing RMB 380 billion in AI and cloud infrastructure over three years, analysts see Alibaba carving out a powerful role in the GenAI race while strengthening its global commerce play.

Goldman Sachs analyst Ronald Keung bumped his target to $163 and maintained a “Buy” rating, noting bigger near-term losses in September but expecting them to shrink by year-end as Alibaba focuses on higher-quality users, trims subsidies, and sharpens delivery efficiency. Keung sees the company evolving into an “AI + everyday consumption app” and an “AI + Cloud hyperscaler.”

JPMorgan analyst Alex Yao went even further, hiking his target to $170 from $140 and keeping an “Overweight” rating, arguing Alibaba’s food delivery and instant commerce arms are now operating at scale. Meanwhile, Bernstein analyst Robin Zhu lifted his target to $160 and kept an “Outperform” rating, impressed by Alibaba’s user figures. Zhu expects food delivery losses to be halved by October, calling Q2 the spending peak before momentum shifts profitably.

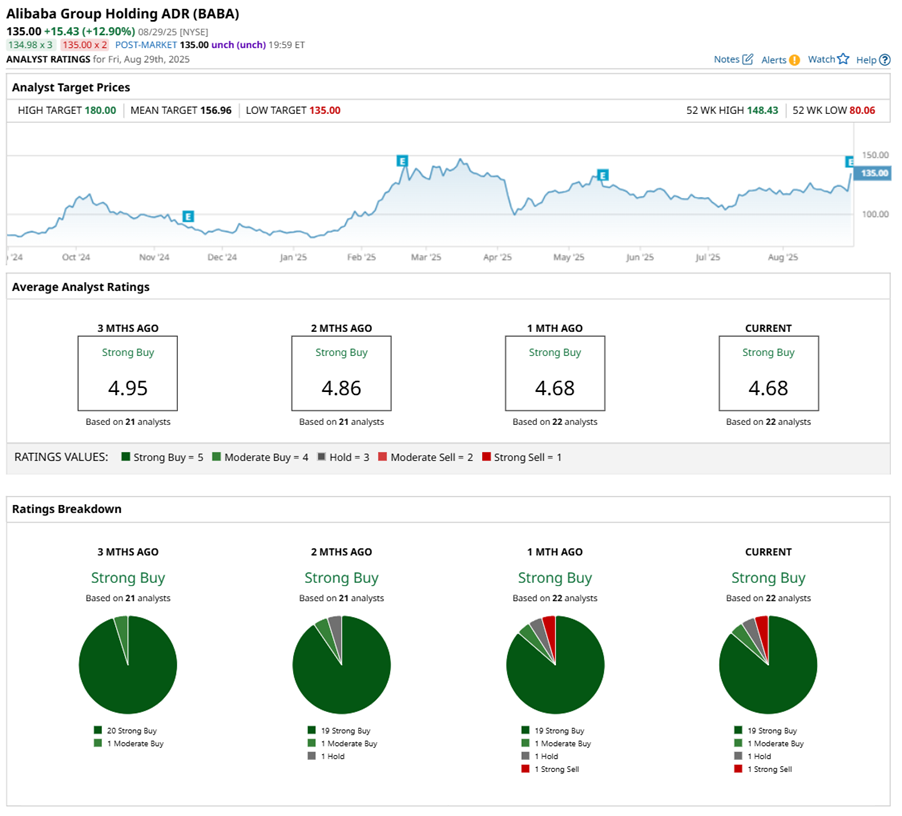

Overall, analysts are upbeat, with BABA stock currently having a “Strong Buy" rating overall. Of the 22 analysts covering the stock, 19 suggest a “Strong Buy,” one advises a “Moderate Buy,” one recommends a “Hold,” and one has a “Strong Sell.”

The mean price target of $162.28 suggests the stock could surge by 19% from current price levels. The Street-high target of $195 represents potential upside of 43%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.