Should You Buy the Post-Earnings Pop in Petco Stock?

Petco Health and Wellness (WOOF) is at a pivotal moment as the pet-care retailer garners renewed investor optimism following its latest earnings report. Markets are responding enthusiastically to signs that its turnaround strategy — emphasizing streamlined operations, improved pricing discipline, and enhanced retail execution — is beginning to resonate.

The company delivered a second-quarter earnings beat on Aug. 28, posting a profit, far ahead of expectations for a loss and prompting the company to raise its full-year outlook. WOOF stock jumped 23.5% on the following day, reflecting investor confidence. Management’s deliberate transformation plan appears to be taking hold, restoring confidence in the company’s ability to strengthen its economic model and revitalize retail fundamentals.

So, is this post-earnings rally a sustainable opportunity? Or just an overreaction to one quarter’s improvement?

About Petco Stock

Petco is a leading health and wellness pet retailer and service provider headquartered in San Diego, California. The company operates a comprehensive pet ecosystem, spanning pet products, grooming, training, veterinary care, and digital platforms, delivered through over 1,500 pet care centers across the U.S., Mexico, and Puerto Rico. Petco’s market capitalization currently stands at around $1.1 billion.

WOOF stock is down 13% year-to-date (YTD), yet has seen an 8% uptick over the trailing 52 weeks, reflecting mixed momentum in a volatile market environment. This performance is largely driven by the company’s surprising turnaround, marked by its second-quarter earnings beat, a return to profitability that sparked a one-day surge of around 23.5%.

However, Petco continues to grapple with headwinds such as declining comparable store sales, partially due to ongoing store closures and intense retail competition, all of which might temper bullish sentiment despite operational improvements.

WOOF stock is trading at a discount compared to the sector median with a price-to-sales (P/S) ratio of 0.21 times.

Petco’s Q2 Earnings Surpassed Projections

Petco unveiled its second-quarter fiscal 2025 results on Aug. 28, delivering a surprising turnaround that marked a pivotal step in its multi-phase transformation strategy. The company reported EPS of $0.05, swinging from a loss in the prior year quarter, and significantly beating analyst expectations. Adjusted EBITDA surged to $113.9 million, an approximately 36.3% year-over-year (YOY) increase, signaling improved profitability.

However, Petco’s net sales declined by 2.3% YOY to $1.5 billion, and comparable store sales slipped 1.4%, pressured by continued store closures. Still, operating income rose by $40.6 million to $43 million, gross margin expanded by around 120 basis points to 39.3%, and free cash flow improved by 28.1% YOY to $53.8 million.

Drawing on this operating momentum, Petco raised its full-year adjusted EBITDA guidance to a range of $385 million to $395 million. For the third quarter, the company projects adjusted EBITDA between $92 million and $94 million, while anticipating net sales to continue declining in the low single digits YOY. Ongoing macroeconomic challenges, including tariff headwinds and soft consumer demand, are expected to impact near-term growth.

Analysts predict loss per share to be around $0.03 for the current fiscal year, an improvement of 86.4% YOY, before improving by another 267% annually to an EPS of $0.05 in the next fiscal year.

What Do Analysts Expect for Petco Stock?

Despite the post-earnings optimism, analysts are largely maintaining cautious or neutral stances. Recently, Jefferies raised its price target on Petco to $4.15 from $4.05, while reiterating a “Hold” rating. The firm highlighted encouraging signs of stabilization and solid profit delivery in Q2, but noted that top-line growth remains absent and more work is needed before Petco can shift toward a stronger growth strategy.

UBS analyst Michael Lasser also raised Petco’s price target to $3.70 from $3.25 while maintaining a “Neutral” rating, noting Q2 margin improvements but emphasizing the need for stronger market share gains.

Meanwhile, Wells Fargo analyst Zachary Fadem lifted his price target to $4 from $3.50 with an “Equal Weight” rating, citing Q2 EBITDA upside and turnaround progress. However, the analyst remains cautious given muted sales and stiff industry competition.

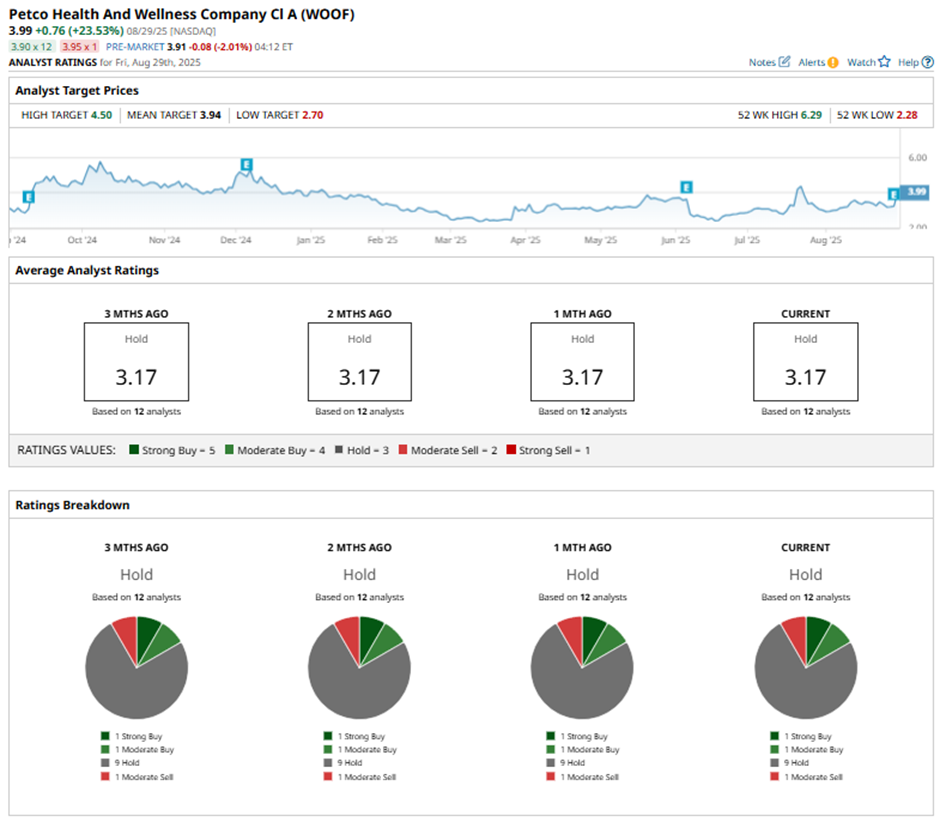

Overall, Wall Street appears cautious about WOOF stock, with a consensus “Hold” rating. Of the 12 analysts offering recommendations, one gives a “Strong Buy,” one maintains a “Moderate Buy,” nine advise a “Hold,” and the remaining one has a “Moderate Sell” rating.

WOOF stock has an average analyst price target of $3.95. implying 19% potential upside currently. The Street-high target price of $4.50 suggests that shares could rally as much as 36% from here.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.