Why HPE Stock Looks Attractive After Q3 Earnings

/Hewlett%20Packard%20Enterprise%20Co%20San%20Jose%20campus-by%20Michael%20Vi%20via%20Shutterstock.jpg)

Hewlett Packard Enterprise (HPE) delivered a strong third-quarter performance, with results reflecting strong demand across its products and services, including momentum in servers, networking, and hybrid cloud segments. Thanks to the solid quarterly numbers, HPE stock was up over 5% in morning trading on Sept. 4.

HPE also closed the acquisition of Juniper Networks during the quarter, which is reshaping its business mix toward higher-growth and higher-margin opportunities.

With strong execution, expanding demand across artificial intelligence (AI), networking, and hybrid cloud, and a sharper focus on profitability, HPE has solid momentum going ahead, which will support its share price.

A Strong Quarter Backed by Broad Demand

Revenue for the quarter totaled $9.1 billion, representing a 19% year-over-year increase. Even when excluding Juniper’s $480 million contribution, sales of $8.7 billion came in strong, reflecting strong demand. Importantly, annualized recurring revenue hit $3.1 billion, up 75% from a year ago. Stripping out Juniper, that figure still rose 40%, reflecting its shift toward a more predictable, higher-margin business model.

HPE Stock’s Growth Catalysts

HPE’s growth is now tied to high-margin networking, AI, and hybrid cloud solutions, all areas with long runways ahead. The integration of its Intelligent Edge business with Juniper under the banner of HPE Networking positions it well to deliver solid growth and margins. Notably, networking is a higher-margin business benefitting from the surge in AI adoption and the ongoing refresh of enterprise and cloud infrastructure. This alignment makes it one of HPE’s most promising growth engines.

Momentum in HPE’s networking business was strong in Q3. The market recovery has been steady, with enterprise demand remaining strong across campus and branch networks, where both wired and wireless upgrades are driving business. The rise of secure access service edge (SASE) and next-generation data center switching has also supported growth. A notable bright spot has been Wi-Fi 7, where orders surged at a triple-digit pace sequentially. On the cloud side, demand for AI-related networking infrastructure is growing rapidly, with Juniper’s routing solutions and HPE’s data center switching solutions seeing robust traction. These trends powered HPE Networking to $1.7 billion in revenue last quarter, a 54% year-over-year jump, reflecting broad-based strength across Intelligent Edge and Juniper.

The server business is also firing on all cylinders. Last quarter, it delivered record revenue of $4.9 billion, a 16% increase from the prior year, driven by a mix of AI-driven demand and steady orders for traditional servers. The revenue from AI systems alone hit $1.6 billion. Importantly, margins in servers have recovered after early-year pricing challenges, with traditional server profitability back at historical levels.

While AI systems carry slightly lower margins due to large deal structures, the growth is staggering as orders nearly doubled quarter-over-quarter, including notable wins in the Middle East and accelerating traction with enterprises worldwide. Even traditional servers are benefiting, as customers move to HPE’s next-generation models powered by AMD (AMD) chips and enhanced with AI-based lifecycle management. The business is gaining from both cyclical IT refreshes and the secular AI demand.

Meanwhile, hybrid cloud continues to gain traction. The segment posted $1.5 billion in revenue, while profit margins expanded significantly. Private cloud AI is also growing at a solid pace, with HPE doubling its customer count in Q3.

While HPE’s revenue is likely to grow at a solid pace, the company’s cost-cutting initiatives are expected to translate into improved profitability.

In short, HPE is no longer just a hardware provider. It has reshaped itself into a diversified technology company with strong growth levers in AI, networking, and hybrid cloud. The Juniper acquisition is a solid growth catalyst, supporting margins and opening up new market opportunities.

The Bottom Line on HPE Stock

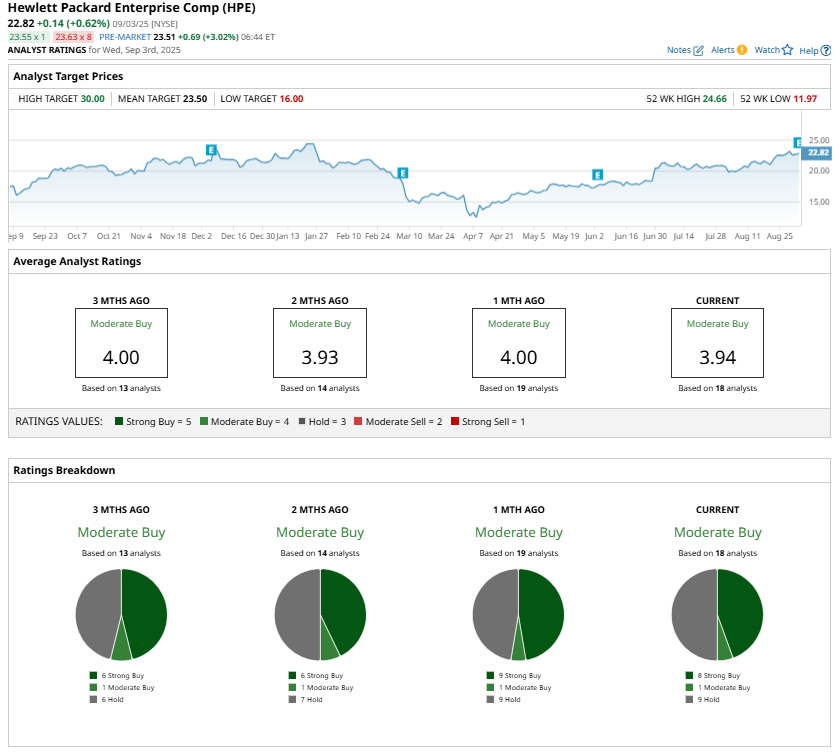

Wall Street is cautiously optimistic about HPE’s prospects and maintains a “Moderate Buy” consensus rating on the stock. However, HPE’s Q3 results reflect the benefits of the transformation into a more diversified, higher-margin technology company. HPE is positioned to capture accelerating demand in AI-driven infrastructure and enterprise networking. With robust growth prospects in networking, servers, and hybrid cloud, and disciplined cost management, HPE is well-positioned to expand profitably, making it an attractive long-term bet.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.